Implementing a new lease accounting software is a complex but crucial step toward ensuring compliance with accounting standards and improving efficiency. Many companies encounter challenges during the implementation process, which…

Lease accounting is a massive, cross-functional effort. It involves various stakeholders and systems that impact (and are impacted by) leases. It is not just an accounting problem – and goes…

What is the Incremental Borrowing Rate? Among the many different calculations used in lease accounting, the incremental borrowing rate may be one of the most misunderstood. Theincremental borrowing rate (IBR)is…

What are rent concessions? Rent concessions are discounts, incentives, or other benefits provided by landlords to tenants. Landlords sometimes offer rent concessions to entice tenants to sign a new…

Woodbridge, N.J. –April 11, 2024 – Visual Lease (VL), the #1 lease optimization software provider, today announced its Q1 results, reporting sustained double-digit annual recurring revenue and customer percentage growth,…

Carbon accounting and sustainability management solution recognized for empowering Enterprises with the data and visibility needed to progress toward their ESG goals Woodbridge, N.J. –February 8, 2024 – Visual Lease…

Lease optimization software provider redefines excellence with a single system of record for lease accounting, management and sustainability tracking Woodbridge, N.J. – January 18, 2024 – Visual Lease (VL), the…

Solution provider is recognized for empowering companies to leverage their lease portfolios for strategic financial and operational outcomes Woodbridge, N.J. – Dec. 21, 2023 – Visual Lease (VL), the #1…

Survey reveals 84% of enterprise organizations are prioritizing lease management due to lease accounting standards and emerging regulatory requirements around environmental impact reporting Woodbridge, N.J. – Oct. 31, 2023 –…

Longstanding pioneer in lease management and accounting continues to advance its platform capabilities to address evolving environmental reporting requirements Woodbridge, NJ – October 16, 2023 — Visual Lease (VL), the…

Woodbridge, NJ – September 27, 2023 — Visual Lease (VL), the #1 lease optimization software provider, today announced the winners of its annual Customer Excellence Awards, recognizing organizations that are…

Woodbridge, NJ – September 19, 2023 — Visual Lease (VL), the #1 lease optimization software provider, today announced the company’s newest offering, VL ESG Steward™, has been recognized by the Business…

Company’s proven SaaS solutions are recognized in first analyst report dedicated to full lease portfolio management Woodbridge, NJ – August 29, 2023 — Visual Lease (VL), the #1 lease optimization…

Company invests in its Partner network in preparation for the next stage of growth Woodbridge, NJ – August 8, 2023 — Visual Lease (VL), the #1 lease optimization software provider,…

Dedicated investments in its solutions, services and leadership expand company value Woodbridge, NJ – July 13, 2023— Visual Lease, the #1 lease optimization software provider, today announced its results from…

Company continues to demonstrate its commitment to strategic growth and operational excellence Woodbridge, NJ – July 6, 2023 — Visual Lease, the #1 lease optimization software provider, today announced the…

Carbon accounting, sustainability management and ESG reporting tool receives global recognition on the heels of newly announced international sustainability standards (IFRS S1 and IFRS S2) Woodbridge, NJ – July 5,…

Company’s innovative solutions and customer-centric approach drive accelerated growth Woodbridge, NJ – April 19, 2023 — Visual Lease, the #1 lease optimization software provider, today announced its results from Q1…

The first sustainability-focused lease tracking and reporting software designed to help companies meet their environmental policy goals Woodbridge, N.J. – March 29, 2023 — Visual Lease, the #1 lease optimization…

88% of businesses are planning for physical space needs just one year or less in advance Woodbridge, N.J. – February 22,2023 — Visual Lease, the #1 lease optimization software provider,…

Private companies and government entities continue to face challenges around properly managing and reporting their leases in accordance with the new lease accounting standards Woodbridge, N.J. – July 25, 2022…

On-demand webinar summary Lease accounting is an incredibly time-consuming, complex endeavor that involves a lot of initial preparation, cross-departmental collaboration and ongoing maintenance. So, how can businesses ensure their lease…

On-demand webinar summary Do you know if you are overpaying for your leases? Unfortunately, many businesses are, but are not aware of it until after they begin tracking their lease…

The new lease accounting standards have radically changed the way private and public companies record leases on the balance sheet. Naturally, this had a direct impact on lessees, lessors and…

On-demand webinar summary According to a recent VLDI survey, 35% of private companies were less than halfway through or had not yet started the process of gathering information needed to…

What is IFRS 16? IFRS 16 Summary: What is IFRS 16? The International Accounting Standards Board (IASB) published the new IFRS 16 lease accounting standard, which replaces IAS 17. For…

The Financial Accounting Standards Board (FASB) recently issued an update to ASC 842 that addresses complexities associated with discount rate calculations. In this blog, we share how this update affects private…

What is lease capitalization? Lease capitalization is the act of recording Right-of-Use Assets and related lease obligations on a company’s balance sheet, as required for the lease accounting standard ASC…

New lease accounting standards coupled with the many pressures brought on by the pandemic have changed how organizations prioritize their leases. Companies are currently reevaluating their lease portfolios to ensure…

You’d be forgiven for gaining a case of whiplash moving from 2020 to 2021. Disaster—a seemingly closed economy, crashed supply chains, tight labor availability, and many millions out of work—turned…

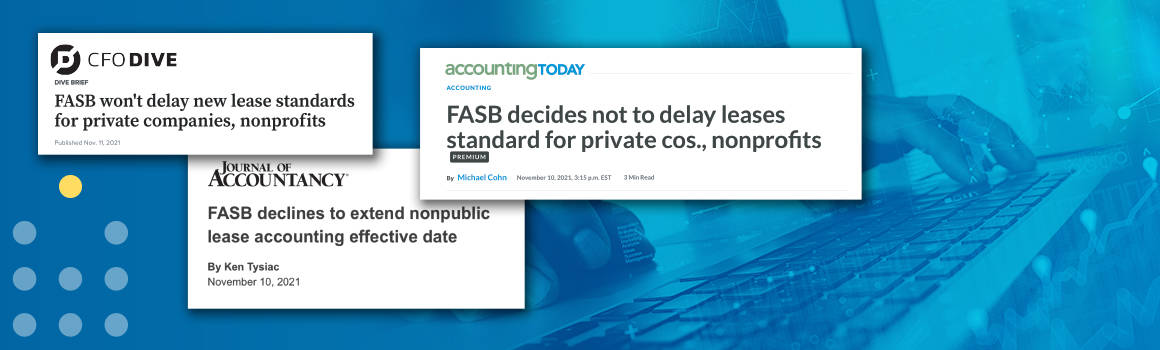

The verdict is in: the Financial Accounting Standards Board (FASB) will not issue a third delay to the ASC 842 effective date for private companies, which will take effect Dec. 15, 2021….

In a piece of good news for Manhattan’s battered office market, over 3M SF of office space was leased in November — the first time since before the coronavirus pandemic…

The FASB on November 11, 2021, published a narrow amendment to ease lease accounting rules for private companies and nonprofits, enabling lessees to have a moreflexible way to elect a…

The Financial Accounting Standards Board issued an accounting standards update Thursday in an effort to simplify the discount rate guidance for lessees that aren’t public companies, including private companies, nonprofits and employee…

Green shoots are beginning to emerge for the office market, with many tenants starting to consider long-term leases — though most firms plan to revise workplace arrangements when the pandemic…

More than double the share of commercial real estate tenants are planning to increase rather than decrease their space next year, according to a survey by the Visual Lease Data…

With the lease accounting standard set to take effect for private companies in mid-December, the Financial Accounting Standards Board will be considering a proposal at a meeting Wednesday to postpone…

Since the onset of the Covid-19 pandemic, businesses have evolved their real estate strategies to comply with the many changes that the pandemic forced upon them. To maintain lease accounting…

The majority of private companies have yet to implement the new lease accounting standard entirely, even though the effective date is fast approaching. Three-quarters (75%) of privately held companies surveyed this spring…

Organization recognized as one of the fastest-growing private companies in America for the second consecutive year Woodbridge, NJ – August 17, 2021 — Visual Lease, the #1 lease optimization software…

Package provides robust tech capabilities and all-inclusive implementation and support required to achieve lease accounting compliance with ASC 842 Woodbridge, NJ – August 10, 2021 — Visual Lease, the #1 lease…

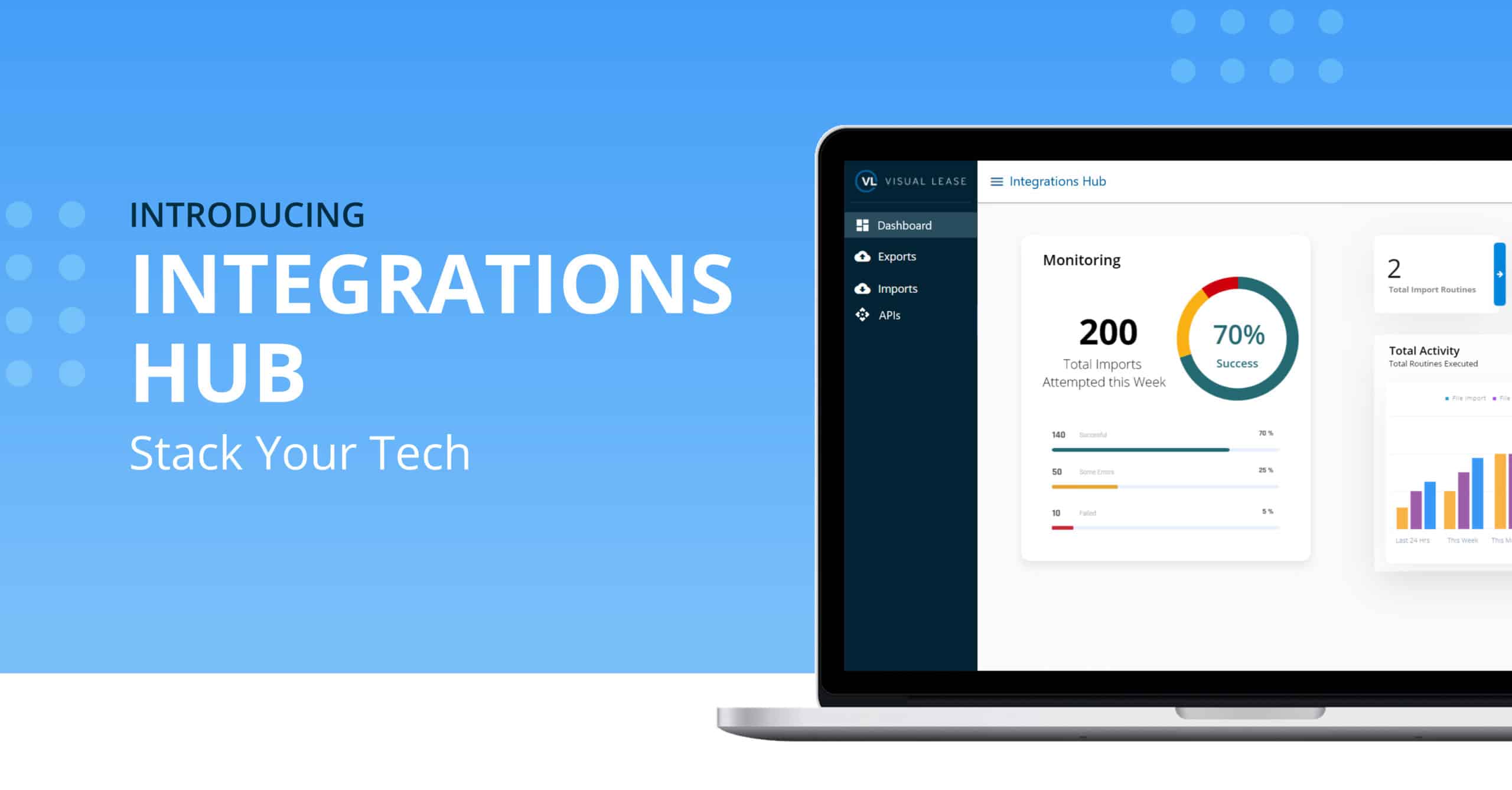

In a 2020 IDC survey, 42% of technology decision makers reported that their organizations planned to invest in technology to close the digital transformation gap. We expect that number has…

There is power within your lease portfolio. Over the last year, public and private businesses have taken a closer look at their leases – and experienced the downstream benefits of…

Last year, the Financial Accounting Standards Board (FASB) provided private companies with an extra year to adopt lease accounting standard ASC 842. When this was announced, 63.8% of surveyed private company executives…

Real estate leases can serve as key strategic assets for companies, presenting opportunities to improve the execution of a business strategy while also creating operational efficiencies. But leases also present…

This article originally appeared here in Forbes. As a result of Covid-19 and the changing landscape related to leases, private companies have received more time to prepare for and adopt…

The Governmental Accounting Standards Board released updated implementation guidance for its leases standard, which is going into effect soon, along with other accounting standards for state and local governments.

This article originally appeared here in Forbes. In 2020, many companies were forced to make tough decisions regarding their leased commercial spaces. From office closures to consolidations and deferrals, many…

Lease accounting (ASC 842, IFRS 16 or GASB 87) is not your average one-and-done disclosure. This whole new approach to accounting requires you to account for lease changes throughout the year with a higher level of scrutiny. A…

Organizations are increasingly seeking flexible lease options, with short-term leases becoming more popular. Lease accounting standards treat different lease lengths differently. This blog explains the ASC 842 requirements for accounting…

Lease portfolios often account for a massive portion of a company’s risk exposure and overhead. And yet, most businesses lack visibility into their leases to understand their obligations and options – and…

How to Abstract, Manage and Report on Lease Data When FASB issued its update to the lease accounting standard, the main goal was to increase the transparency and comparability of financial reporting. …

Hundreds of private organizations have begun their journey towards lease accounting compliance. Although, many of them underestimate the amount of effort involved with preparation. In particular, assembling a team…

The start of the new year means planning for what you need to accomplish in 2020. For accounting teams in private companies, there’s a big task on your plate this…

When companies think about purchasing lease accounting and lease administration software, many make the mistake of considering these tools as a cost of doing business. The mistake is understandable, because…

For private companies faced with adopting ASC 842 and/ or IFRS 16 this year, there are many complex lease accounting decisions to make. These decisions impact not only your compliance…

For most corporate attorneys, FASB ASC 842 compliance is an accounting exercise that is only vaguely on their radar (if at all). Here is why that is as a major…