GASB 87 Summary

Issued by the Governmental Accounting Standard’s Board in June of 2017, GASB 87 is the new lease accounting standard for US government entities. All entities that prepare financial statements in accordance with GASB standards must comply with GASB 87 for fiscal years beginning after June 15, 2021.

Who is subject to GASB 87?

- State, local and municipal governments

- Public benefit corporations and authorities

- Public employee retirement systems

- Public utilities, hospitals and other healthcare providers

- Public colleges and universities

How does GASB 87 impact lessees and lessors?

- Lessees: Must recognize lease liabilities and intangible right of use (ROU) lease assets on their statements

- Lessors: Must recognize lease receivables and deferred inflows of resources on their financial statements

Was GASB 87 postponed?

The Governmental Accounting Standards Board postponed the implementation date for GASB 87 back in May of 2020. The extension was implemented in order to give CPA firms and entities an opportunity to prepare to implement the new standard after disruptions during the COVID-19 pandemic.

What does GASB 87 do?

In 2017, the Governmental Accounting Standards Board (GASB) published the lease accounting standard GASB 87. The organization is the source of the accounting principles (GAAP) used by state and local governments in the United States.

GASB 87 was created to increase visibility into lease obligations and remove ambiguity around lease obligations in financial disclosures, particularly balance sheets and income statements.

What did GASB 87 replace?

GASB 87 replaces the current operating and capital lease categories with a single model for lease accounting based on a definition of leases as contracts that convey control of the right to use a non-financial asset. The new rules require lessees to recognize a lease liability and an intangible asset while lessors are required to recognize lease receivables and a deferred inflow of resources on their financial statements.

How Does GASB 87 Change the Balance Sheet?

GASB 87 requires organizations to now record most leases on the balance sheet.

For most organizations, this is a massive administrative lift. Leases are complex legal documents, sometimes hundreds of pages, which require trained professionals to negotiate and interpret; with countless obligations, clauses and critical dates to keep track of.

Leases are also dynamic. Terms change all the time as organizations take on new spaces, scale back or renegotiate, and you must account for every change under GASB 87.

To produce accurate and compliant lease accounting reports, the following information needs to be collected and tracked:

- Lease terms

- Discount rate

- Rent payment amounts and dates

- Lease option terms

- Variable or percentage rent terms

- Residual value guarantee terms

Definition of a Lease Under GASB 87

Under GASB 87, a lease is defined as a contract that conveys the right to use another entity’s nonfinancial asset for a period of time, including:

- The ability to obtain the present use of the asset as specified in the contract

- The right to control how the underlying asset is used

Examples of Leased Assets Under GASB 87

Some common examples of leased assets recorded under GASB 87 include:

- Equipment for day-to-day operations (office equipment, medical equipment, telecommunications equipment, IT equipment)

- Vehicles (automobiles, vans, trucks)

- Real estate (property, buildings, offices, warehouses)

Lease exemptions under GASB 87

Somme leases are exempt under GASB 87, such as:

- Leases of certain types of intangible assets (e.g., patents, software licenses, the rights to explore for or exploit natural resources such as oil, gas, minerals and similar nonrenewable resources)

- Leases of biological assets, including timber, living plants and living animals

- Leases of inventory

- Service concession agreements

Lease Accounting Calculations Under GASB 87

Lease Accounting for Lessees

Under GASB 87, lessees must recognize a lease liability and a right to use asset for all qualified leases.

• The lease liability is generally calculated as the present value of payments the lessee expects to make during the lease term, including any contract renewal options the lessee is reasonably certain to exercise.

• The lease asset is calculated as the lease liability plus any prepayments or initial direct costs, minus any lease incentives at or before commencement of the lease.

As payments are made on the lease, the liability amount is reduced and interest expenses are recognized. The asset is amortized over the length of the lease term or over the life of the asset (whichever is shorter), unless the lease contains a purchase option that the lessee has determined is reasonably certain to be exercised, in which case, the lease asset should be amortized over the useful life of the underlying asset.

Lease Accounting for Lessors

Under GASB 87, lessors must recognize a lease receivable and a deferred inflow of resources on the financial statements. Just as with lessee schedules, the calculations can be complex.

• At the start of the contract, the lease receivable is generally calculated as the present value of lease payments the lessor expects to receive over the term of the lease, minus any provision for estimated uncollectible amounts.

• The deferred inflow is calculated as the lease receivable plus any payments made at or prior to the commencement of the lease.

As the lessor receives payments, the lease receivable amount is reduced and interest revenue is recognized. The deferred inflow continues to be recognized as revenue over the life of a lease.

Lease Accounting Remeasurements for GASB 87

Organizations remeasure the value of lease assets and liabilities when there is some significant event or material change in circumstances, including:

- Modification of a lease term, size or payment obligations — for example, the extension or expansion of a lease or the exercising of a lease option

- Lease contraction due to full or partial lease termination or abandonment — for example, when an abandoned space is sublet, causing the abandonment of the primary asset

- The full or partial impairment of a lease

| Remeasurements type | Description |

|---|---|

| Modification | Any modification of lease term (i.e., change in payment term, extension of lease term, etc.) |

| Full Impairment | Due to some event, the asset no longer has any value, but the organization still has obligation under the lease. |

| Partial Impairment | Due to some event, the asset still has a value, but the value has been reduced by some amount or percentage. |

| Full Termination | A lessee has ended the lease contract and no longer has the lease liability or asset on the books. |

| Partial Termination | A lessee reduces the use of some portion of the asset (e.g., reduces total square footage of lease by terminating some portion), which reduces the amount of liability or asset on the books. |

| Full Abandonment | A lessee decides to no longer use the entire asset as of some specific date; the lease contract is still in place and the asset remains as a liability on the financial statement. |

| Partial Abandonment | A lessee decides to no longer use a portion of the asset as of some specific date; the asset remains as a liability on the financial statement. |

Disclosure Reporting Under GASB 87

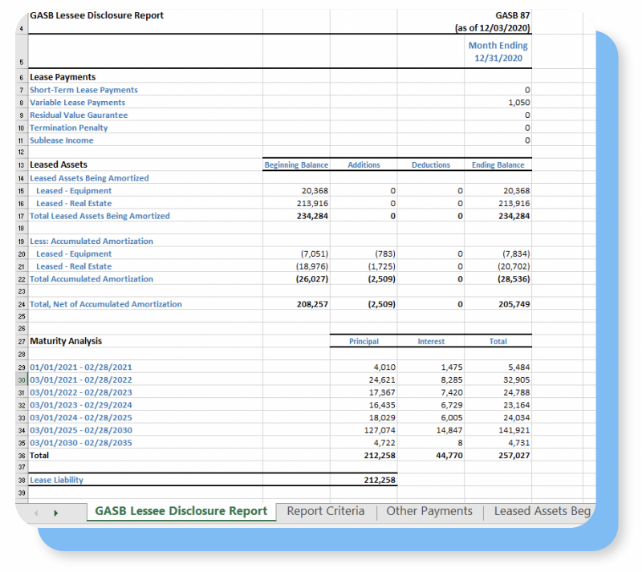

For both lessees and lessors, GASB 87 now requires disclosure reports that provide aggregated totals and detailed supporting data such as:

- Qualitative and quantitative information about leases, including variable payments not included in measurement of liability

- Significant assumptions and judgments made when measuring leases

- The amounts recognized in financial statements

Lessee disclosure reports must provide:

- Fully detailed lease descriptions

- Amount of total leased assets — both gross and net figures

- Future lease payment schedules, including interest payments

Lessor disclosure reports must provide:

- General descriptions of all lease arrangements

- Inflows of resources, including lease and interest revenue recognized in the reporting period

- Revenue from variable payment components not included in the lease receivable

These new standards require organizations to gather and manage substantial amounts of data to generate disclosure reports related to real estate, equipment, vehicles, land and any other leases an organization holds.

GASB 87 Compliance Software

GASB 87 Compliance Software

Visual Lease’s GASB 87 lease accounting software is the perfect tool to keep all of your leases in one single location, while making sure you stay completely GASB 87 compliant.

GASB 87 Software Checklist

When planning and preparing for GASB 87 and evaluating lease accounting software, naturally you’ll want to look for a solution that specifically supports GASB 87, which requires all contracts that meet the definition of a lease to be recognized in financial statements and classified as a finance lease.

In addition, to ease the transition to GASB 87 and streamline the lease accounting process, you’ll want to look for a solution with the following capabilities and benefits.

Simplify Lease Data Integration and Compliance

- Streamline lease data collection with other business applications, such as ERPs and accounts receivable

- Enable automated calculations and financial reports

- Support configurable data fields and reports to match your compliance requirements and organizational needs

- Centralize all your lease information within one system

Designed with Financial Expertise and Future Readiness in Mind

- Incorporate years of lease financial management experience built within each feature and functionality

- Prioritize future-readiness with ongoing investments in R&D

- Focus on data security and privacy

Improve Visibility and Control Over Lease Management

- Provide data visualization for visibility into lease details and costs, enabling more informed business decisions

- Streamline lease detail management via system alerts for lease events and changes that could impact your ongoing financial reporting

What To Look For in GASB 87-Complaint Lease Accounting Software

Spreadsheets aren’t designed to handle the dynamics and complexity that impact the accounting calculations — lease transactions can result in hundreds of permutations and calculations. Most likely your current lease process has gaps that will need to be addressed when moving to adopt GASB 87. Many of these gaps can be addressed through the use of technology. Lease accounting software can help you meet GASB 87 requirements and maintain compliance beyond the initial reporting period.

Evaluating lease accounting technology

The right lease accounting software solution provides you with the proper tools to manage lease data and changes, perform the necessary calculations and generate reports according to GASB standards. In addition, choosing lease accounting and management software will help to further streamline the accounting process and ensure ongoing GASB compliance.

Your lease accounting and management software should offer not only ongoing compliance via modification, impairment, termination capabilities but also:

- Lessee and lessor accounting

- Disclosure reporting capabilities

- Automated calculations

- Journal entries

- Lease amortization schedule

- Roll-forward reporting

- Handling for regulated leases

- Handling for short-term leases

Compliance starts with a lease subledger

GASB 87 introduces a much higher level of scrutiny. Now, organizations have significantly more lease information to track, update, calculate and report on. Given the cross-functional, complex and evolving nature of lease language, any lease accounting solution should start with a strong lease management software to act as a single system of record for all lease data and lease financials.

- Configurable tools to handle any lease scenario across any asset type to maintain a reliable, up-to-date source for qualitative lease details such as terms, changes and dates

- Integration capabilities to other cross-functional systems to maintain a single source of truth

- A comprehensive audit trail to track and reconcile any changes

- Defined user roles for anyone that touches leases and integrated guardrails to ensure any changes are in accordance with internal accounting procedures

A lease software solution helps to streamlines this very complex process by providing automated calculations and workflows to:

- Ensure that leases and the related assets, liabilities, revenues and expenses are accounted for consistently

- Eliminate human error and reliance on formulas and cumbersome spreadsheets • Ensure accuracy by having all data and calculations in one system

- Integrate leases and their pertinent data, such as liabilities, lease assets, interest expenses and revenue inflows, to the financial statements

- Automatically generate journal entries and lease amortization schedules using the system data

Lease reassessments and remeasurements

With the enhanced level of lease visibility that GASB 87 requires, an organization’s lease accounting must explain all lease changes on the financial statements. This includes additions or subtractions due to new leases, modifications, impairments and terminations, as well as regular amortization.

Accounting for lease remeasurement and reassessments is a common roadblock to sustainable compliance as accounting teams must rely on cross-functional stakeholders adhering to internal procedures as they manage lease modifications.

Using lease technology to organize, update and manage lease data allows you to integrate lease renewals and other modifications into your accounting process, ensuring they are captured accurately and reported in a timely manner.

Roll-forward reports are a valuable tool for meeting this requirement, providing a detailed disclosure of lease financials including period over period changes to lease assets and liabilities.

By choosing a technology platform that automates roll-forward reporting, your organization can streamline data gathering, calculations and reporting while ensuring that the process meets compliance and disclosure requirements.

Alerts, approvals, internal controls and audit trails

Given the cross-functional nature of lease management, defined user roles and alerts and comprehensive approvals hierarchies are critical to maintaining a single source of truth.

Look for systems that can streamline cross-functional workflows both internally and externally, with project management systems that can notify appropriate stakeholders when upcoming critical dates are near.

Auditability cannot be compromised. Approvals hierarchies are important to make sure that mistakes – or intentional malfeasance – are identified. Audit trails must be maintained to track every change.