IFRS 16 compliance

As your leases evolve, it’s hard to keep up. Visual Lease makes it easy to handle the complexity of lease contracts, projects and workflows. And our lease accounting and administration software provides auditability through every change, so you never have to question your data.

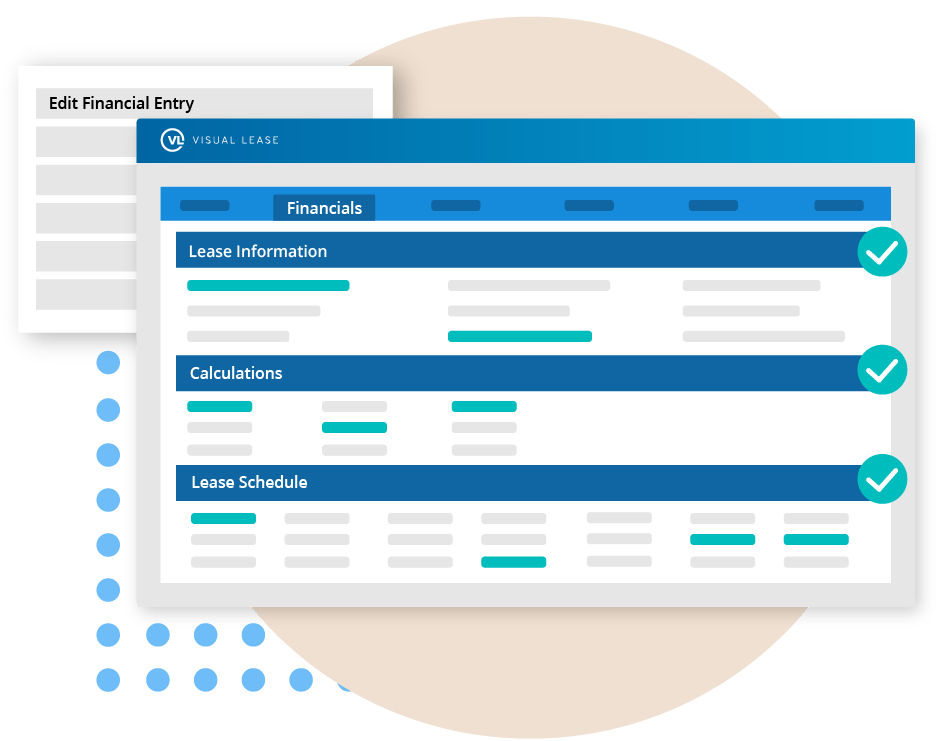

Automated Lease Accounting

Supercharge your lease accounting process with automated software that delivers unparalleled efficiency and eliminates errors, ensuring flawless compliance.

Configured to meet all IFRS 16 Disclosure Requirements

Take your lease accounting to the next level with software that can be tailored to meet all IFRS 16 disclosure requirements.

Comprehensive Data Entry Validation

Experience peace of mind and increased confidence in your lease management processes with robust validation features. Prevent errors, promote accurate financial data, and enhance internal controls, ensuring reliable and trustworthy lease information.

Role-Based Access

By providing tailored access permissions, you get maximized data security, enhanced collaboration, and access to top-notch information for more impactful decision-making.

Loved by leaders

More than 1,500 organizations trust Visual Lease to account for their leases.

Additional IFRS 16 Resources

IFRS 16 Frequently Asked Questions

What is IFRS 16?

IFRS 16 also known as International Financial Reporting Standard 16, is an accounting standard issued by the International Accounting Standards Board (IASB). It primarily focuses on lease accounting and replaces the previous standard IAS 17.

- IFRS 16 introduces significant changes in the way leases are recognized, measured, and presented in financial statements. It aims to provide a more accurate representation of an organization’s leasing activities and their impact on financial statements. The standard applies to all leases, including both lessees (the party that obtains the right to use an asset) and lessors (the party that grants the right to use an asset). For more information, check out our IFRS 16 Summary blog.

When was the IFRS 16 effective date?

The effective date for IFRS 16, as set by the International Accounting Standards Board (IASB), was January 1, 2019. This means that companies were required to apply the standard to their financial statements for reporting periods beginning on or after January 1, 2019.

Who does IFRS 16 apply to?

IFRS 16 applies to both lessees (the party that obtains the right to use an asset) and lessors (the party that grants the right to use an asset). It is applicable to entities that prepare their financial statements in accordance with International Financial Reporting Standards (IFRS), which includes many countries around the world.

The standard applies to a wide range of entities, including but not limited to:

- Publicly traded companies listed on stock exchanges that follow IFRS.

- Private companies that choose to adopt IFRS voluntarily.

- Not-for-profit organizations that prepare their financial statements using IFRS.

- Government entities that follow IFRS for their financial reporting.

IFRS 16 will have a significant impact on companies that have relied on off-balance sheet financing in the form of operating leases, particularly in the airline, retail, transportation, telecommunication, and energy sectors.

IFRS 16 Lease Accounting Software that Achieves Compliance

Visual Lease is designed so you can optimize management of your lease portfolio – from IFRS 16 compliance, to ASC 842 and GASB 87.

Full Automation

Harness the power of an IFRS 16 software to effortlessly streamline lease accounting, automate complex calculations, and ensure seamless compliance with the standard's requirements, revolutionizing your IFRS workflows with efficiency and accuracy.

Guaranteed Accuracy

By automating lease accounting workflows and providing centralized lease data management, an IFRS 16 software eliminates human error and ensures compliance with the standard's requirements, enabling you to accurately manage lease portfolios with ease. Additionally, with automated alerts for lease-related deadlines, an IFRS 16 software keeps you ahead of the curve, enabling timely action and seamless compliance.

Access to Centralized Data

With an IFRS 16 software's centralized data management, companies gain access to a single source of truth, streamlining documentation management, reducing manual efforts, and eliminating data discrepancies. This not only ensures accurate and up-to-date lease information but also leads to significant cost savings by minimizing administrative burdens and maximizing operational efficiency.

Cost Effective

Unleash the power of an IFRS 16 software to drive cost-effectiveness through automation and customization, slashing operational costs by eliminating manual processes, increasing efficiency, and reducing errors. By automating complex lease accounting workflows and tailoring the software to your specific needs, you can optimize resource allocation, minimize expenses, and maximize your return on investment.