Our platform empowers business service providers to easily manage their portfolios, uncover insights, and optimize strategies across real estate, procurement, and ESG.

Reduce Risk & Costs. Maintain Compliance. Make Better Business Decisions.

Discover why leading companies like Gartner, PayPal, and Pitney Bowes trust Visual Lease to manage their leases.

Regulatory compliance is just the beginning of what Visual Lease (VL) can help you achieve.

Visual Lease by the numbers

Customers

Retention

Records under management

Seamlessly manage your records.

Consolidate your office leases, contracts, utility bills, and environmental data into a single platform, gaining a comprehensive view of each asset’s key details, financials, and environmental impact. Whether you’re managing leases for office spaces, call centers, or client-facing facilities, our platform ensures everything is organized and accessible.

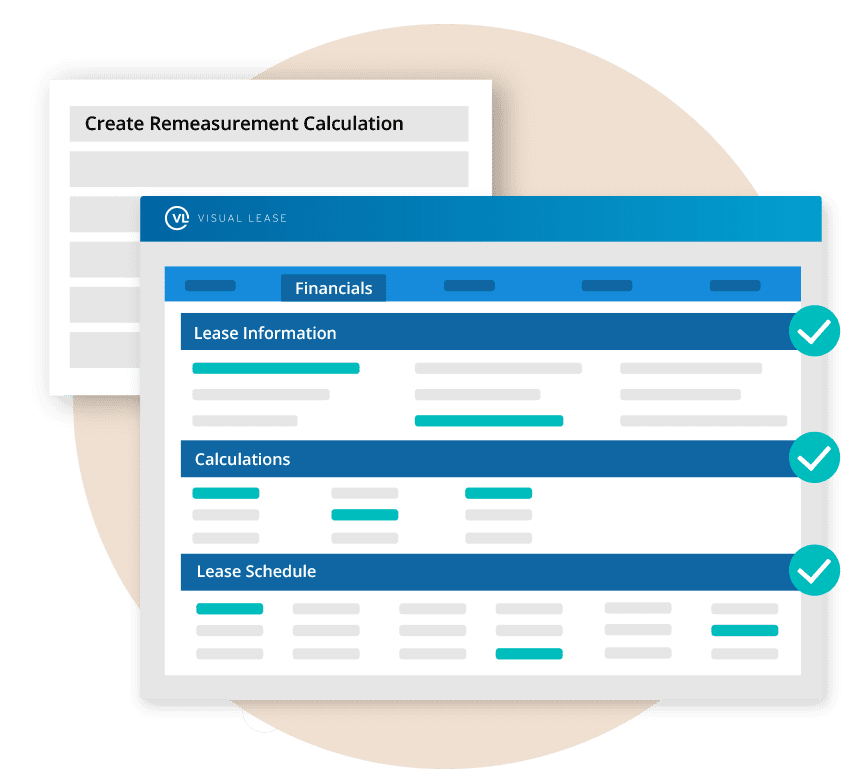

Account for every asset in a single subledger.

Manage expenses like reimbursements office buildouts, and IT infrastructure costs with ease, and reconcile CAM/OpEx payments for your office spaces all in one centralized location. Ensure that your software agreements and operational leases are accounted for accurately, streamlining your financial management.

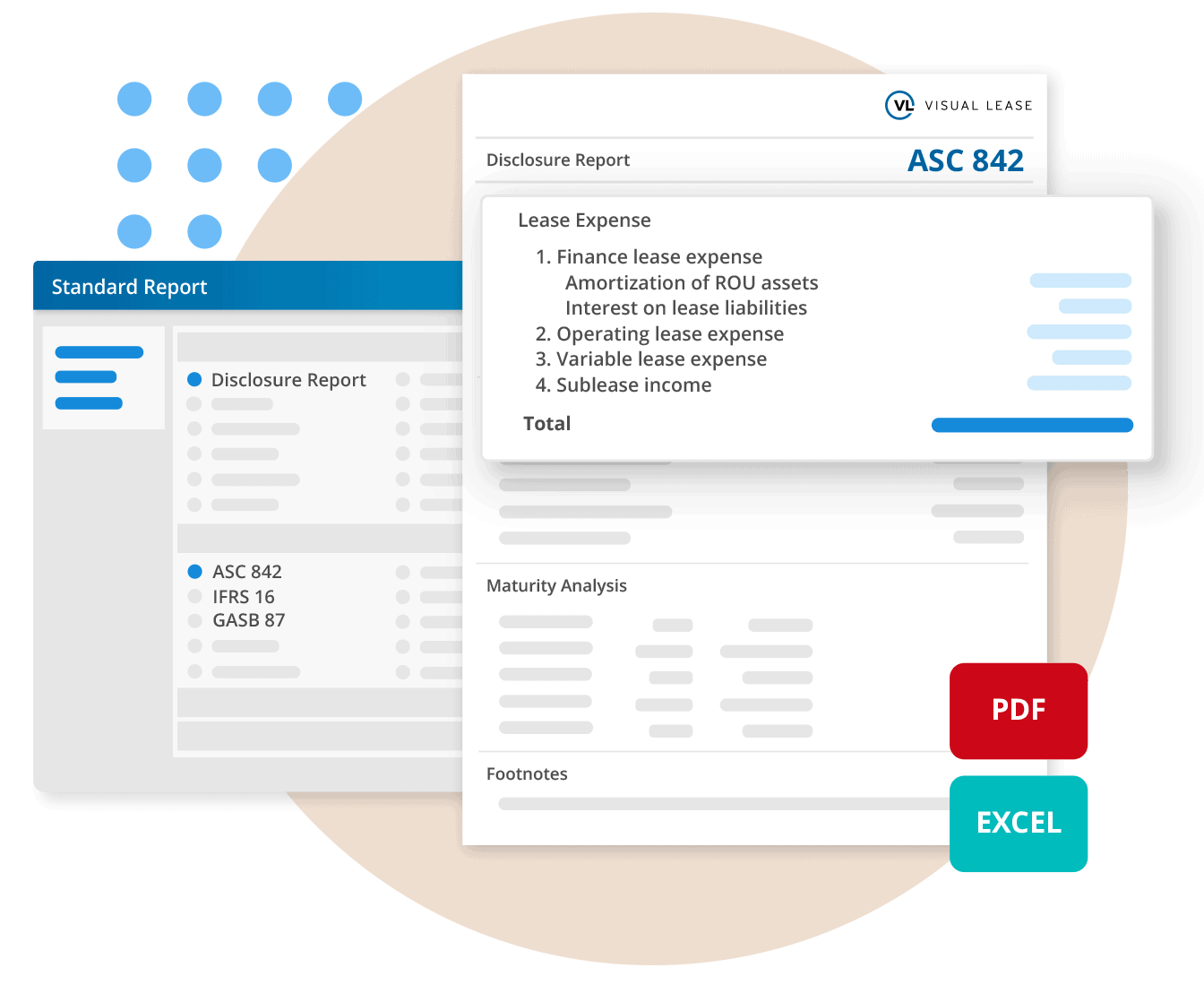

Streamline regulatory compliance and month-end close.

Generate journal entries with transparent calculations backed by a bi-annual SOC I Type II audit. Leverage robust reports with supporting maturity analyses including pre-built, third-party tested disclosures, roll-forward, and cash flow reports. Simplify the financial close process, whether you’re managing leases for multiple office locations or contracts across various service lines.

Utilize powerful third-party system integrations.

Leverage your lease data across systems with secure file transfers and flexible APIs. Seamlessly connect your ERP and import journal entries into your general ledger or track rent payments and service fees within accounts payable, ensuring your financial data flows smoothly across your business services operations.

Optimize your financial operations.

VL’s AI-driven financial forecasting and analysis tools support strategic decision-making, enabling your team to focus on high-value activities rather than manual data crunching. Whether you’re planning for M&A, analyzing cost-saving opportunities, or managing vendor contracts, our tools empower your business to operate efficiently.

Establish your baseline emissions in half the time.

Track energy, water, waste, and biodiversity data for leased and owned assets, including office buildings and operational facilities. Upload supporting documents, create a complete emissions inventory, and generate reports compliant with GRI, ISSB, TCFD, EFRAG, and the Greenhouse Gas Protocol.

VL's award winning, all-inclusive support model:

Guided implementation

Our dedicated customer success managers will configure your system, controls, and data for optimal performance. We understand the unique needs of business services, from managing office leases to tracking software agreements, and are here to get you up and running efficiently.

Expert support at no extra cost

We are committed to your success with no hidden fees. Our experts are knowledgeable in the business services industry and available to address your questions and keep your business moving forward, ensuring you get the most value from our platform.

On-demand training

VL is user-friendly, with comprehensive system trainings and how-to guides available on demand.

Dedicated account team

Our all-inclusive support model features a dedicated account team committed to helping you maximize your system’s potential and achieve your business objectives.

Business Services Frequently Asked Questions

How do I generate occupancy cost reports for each consulting practice group?

With configurable lease tagging and department-level tracking, Visual Lease enables firms to allocate occupancy costs by business unit or practice group. Our reporting engine pulls from both financial and operational data to produce real-time insights into square footage usage, cost per seat, and ROI by team. These reports support executive decision-making around space optimization and budgeting.

How are project costs allocated when one lease supports multiple engagements?

Visual Lease supports project-based accounting by allowing users to assign lease costs to multiple clients or engagements using custom dimensions. Allocation rules can be based on square footage, headcount, or percentage of use, enabling accurate cost recovery and alignment with client billing. This helps services firms manage shared lease expenses with precision across project portfolios.

What features help with fast M&A lease portfolio integration?

Our platform streamlines M&A onboarding with bulk upload tools, configurable data fields, and automated abstraction workflows. Visual Lease integrates easily with your existing ERP and project systems, allowing newly acquired leases to be incorporated quickly, without disrupting reporting or compliance. Role-based access and audit logs ensure that integration remains secure and traceable throughout the process.

How do we tag leases by cost center and sync entries to project accounting?

Visual Lease allows you to apply cost center tags to any lease, ensuring transactions are routed accurately to project accounting tools. Automated journal entries can be configured to include these dimensions and pushed directly to your GL or ERP through secure integrations. This eliminates manual rework and improves accuracy in financial reporting.

How does the system automate CPI rent adjustments common in flexible office leases?

CPI adjustments are built into our lease calculation engine. Users can input lease clauses and define escalation terms tied to external indices. The system automatically applies CPI-based rent increases as scheduled and reflects them in financial reports. This reduces the risk of underpayment or overpayment and simplifies compliance with lease terms.

Can we set alerts when parking lease costs rise above client recovery rates?

Yes. Visual Lease supports custom alerts for any lease cost element, including parking expenses. You can configure notifications when actual costs exceed predefined thresholds, such as your billable recovery rate for a client engagement. This helps control overhead and allows for proactive cost management.

How can we model break‑even occupancy levels for hybrid‑work scenarios?

By centralizing lease and utilization data, Visual Lease gives you a clear view of space usage versus costs. Combine seat counts, usage trends, and lease terms to calculate break-even occupancy levels. Custom dashboards let you model scenarios and forecast the impact of footprint changes, helping you right-size office space in line with hybrid work patterns.

How can I bulk‑update lease records when we shift to hoteling desks?

Visual Lease enables mass updates across lease records using our bulk edit tools. You can quickly modify asset details, usage types, or associated cost centers when converting traditional seating to hoteling. These updates ensure your portfolio stays aligned with workplace strategy and supports accurate space and cost reporting.

What our customers say about us

Anthony Cacchiani

Senior Manager, Global Finance at Indeed

Downloads & Resources

2023 Commercial Real Estate & Leasing Trend Report

Read More

A Complete Guide to Lease Accounting

Read More

Buyer's Guide to Lease Accounting Software

Read More

Commercial Real Estate in 2022 Report

Read More

Lease Accounting and Lease Administration Why You Need Both Whitepaper

Read More

Lease Accounting Business Services

Read More

Newmark: Case Study

Read More