We’ve taken on the heavy lifting for more than 1,500 organizations, helping them to gain control over their lease portfolio.

VL: Constructed to Handle Complex Lease Portfolios

Take control of your leased and owned assets and maintain confident compliance with VL.

With VL, you can build a solid foundation for sustained lease accounting and lease management.

Visual Lease by the numbers

Customers

Retention

Records under management

All your assets in one place.

Robust lease management tools built to help construction teams manage complex contracts and financials for equipment, machinery, vehicles, and real estate, including sub-leases, master leases, embedded leases, and owned assets. Whether you’re managing heavy machinery leases across multiple job sites or office space for project management teams, our platform keeps everything centralized and accessible.

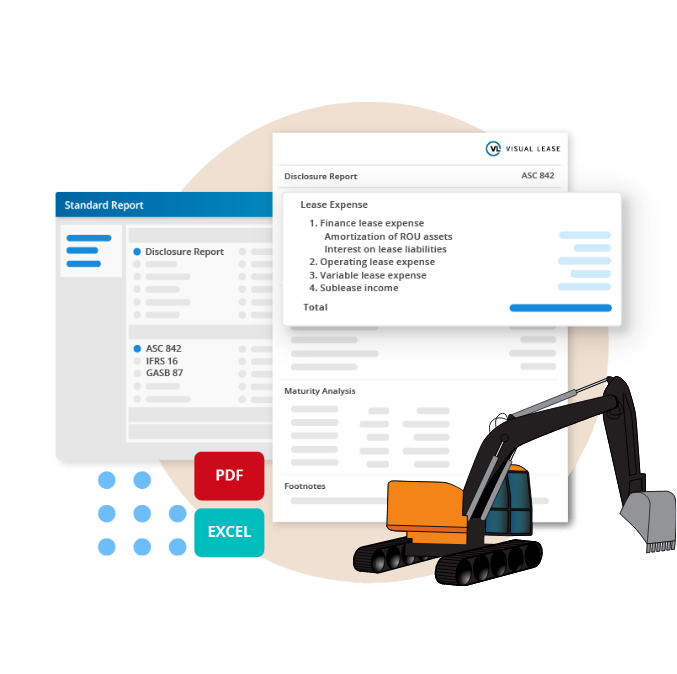

Streamline ASC 842, IFRS 16 compliance, and month-end close.

Generate journal entries and pre-built, third-party tested disclosures, roll-forward, and cash-flow reports with a single click, ensuring compliance and accuracy for all your construction assets, from cranes and excavators to office trailers and temporary facilities.

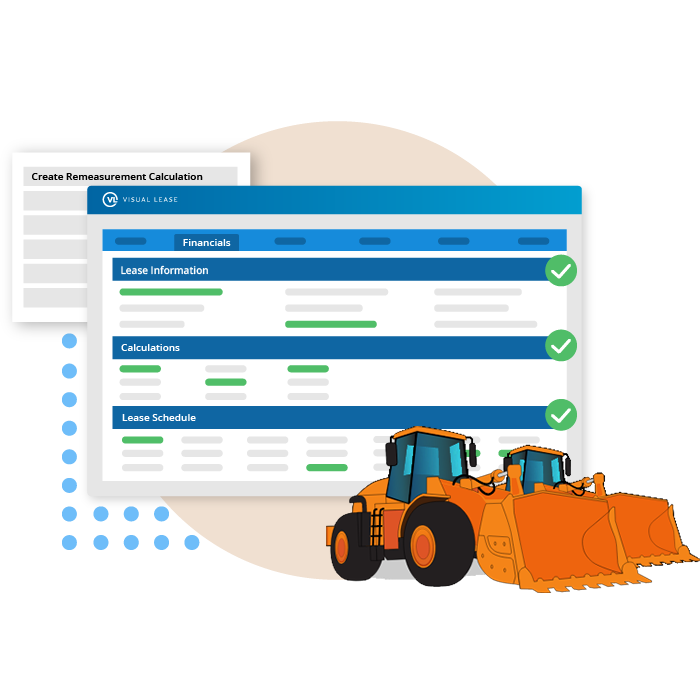

Ensure accuracy through every modification.

Configure auditable, preventative, and detective controls to maintain data integrity, including a complete audit trail. Streamline changes with complete modifications and subsequent remeasurements, whether you’re renegotiating equipment leases due to project delays or adjusting real estate leases to accommodate new project offices.

Benefit from intelligent imports and integrations.

Bulk import and upload templates catch potential errors before they can disrupt your projects. Flexible integrations make it easy to connect any ERP or third-party software, ensuring your construction financials, lease data, and project management tools work seamlessly together.

Automate your lease administration.

Our AI-driven tools streamline lease management processes, reducing manual effort and errors. This includes automated data extraction from lease documents and proactive alerts for key dates and obligations, such as equipment maintenance schedules, lease renewals, and payment deadlines, across all of your construction assets and projects.

Capture and report on your carbon footprint.

Track energy, water, waste, and biodiversity data for leased and owned construction assets, including job site offices, machinery, and vehicles. Upload supporting documents, create a complete emissions inventory, and generate reports compliant with GRI, ISSB, TCFD, EFRAG, and the Greenhouse Gas Protocol.

VL’s award-winning, all-inclusive support model:

Guided implementation

Our dedicated customer success managers will configure your system, controls, and data for optimal performance.

Expert support at no extra cost

We prioritize your success without additional charges. Our experts, experienced in construction operations, are available to answer your questions and ensure you keep progressing without any hidden fees.

On-demand training

VL is user-friendly, with comprehensive system trainings and how-to guides available on demand.

Dedicated account team

Our all-inclusive support model features a dedicated account team committed to helping you maximize your system’s potential and achieve your goals.

What our customers say:

Jon Hunke

VP of Accounting & Information Technology at EVERUS Construction

Downloads & Resources

2022 Lease Accounting Market Analysis Construction

Read More

A Complete Guide to Lease Accounting: Construction

Read More

Apex Tool Group Case Study

Read More

Buyer's Guide to Lease Accounting Software: Construction

Read More

Commercial Real Estate in 2022 - Construction Report

Read More

Equipment Fleet Management

Read More

Lease Accounting and Lease Administration. Why You Need Both.

Read More