Manage and maximize every asset in your portfolio all in one place. Visual Lease brings lease accounting and management software together so you can take advantage of every opportunity.

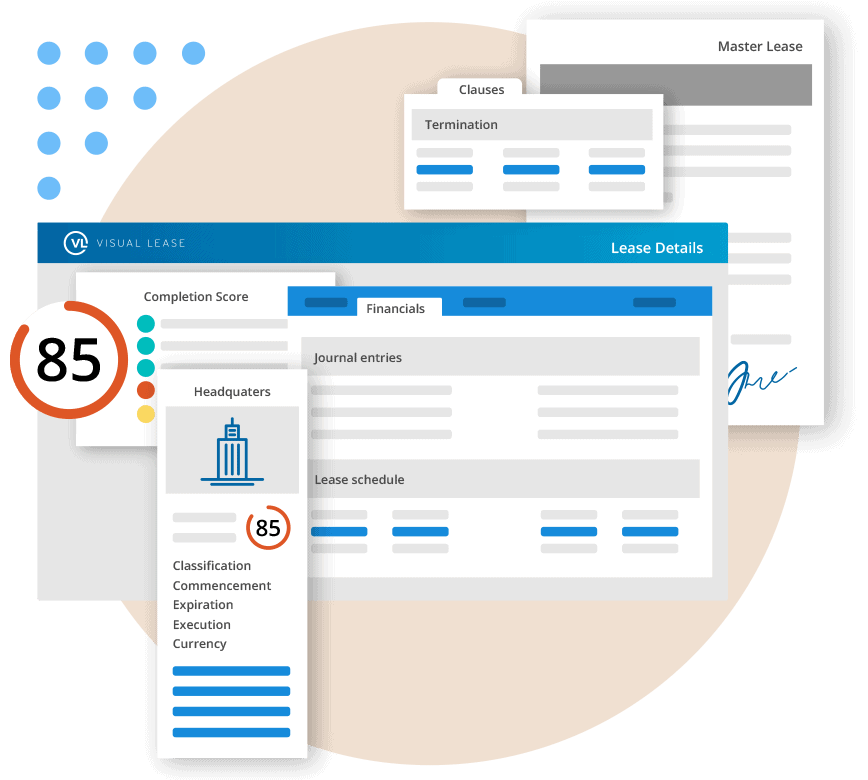

Don’t just run the numbers.

Rule them.

Generate the calculations, disclosures and journal

entries you need to comply with the ASC 842, IFRS 16

and GASB 87 accounting standards.

Track changes and maintain compliance year-

round with a comprehensive audit trail.

Don’t just manage your leases.

Master them.

Don’t let your leases become a liability.

Take control, get compliant and unlock value from

every asset in your lease portfolio, all in one place.

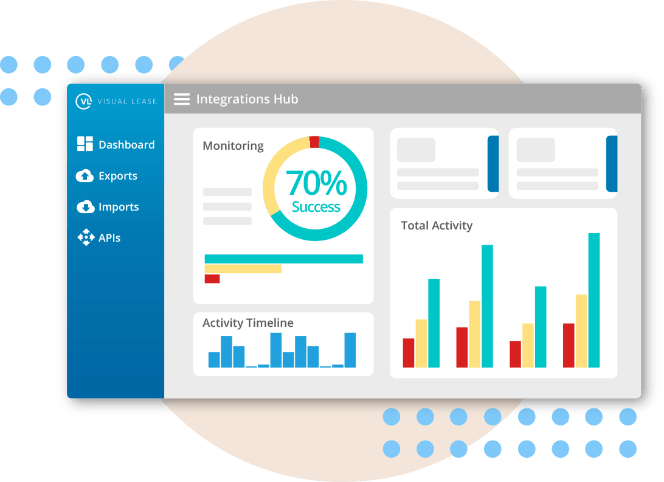

Don’t just connect your data.

Command it.

Streamline workflows across systems and

leverage lease data across your business with

secure, auditable file transfers and flexible APIs

in the Integrations Hub.

Don’t worry.

We’re here to help.

They’re here to help you hit the ground running in 90

days or less and feel confident every step of the way.

Loved by leaders

More than 1,000 companies trust Visual Lease with their lease portfolio.

And 99% renew their contract every year.

More Information on Lease Accounting Software

What should I look for in lease accounting software?

What is the best lease accounting and management software, and how do you choose the right solution for your company? Because significant time and cost are involved in implementing lease accounting software, you want to be sure to choose a solution that meets the needs of your accounting team and your business while helping you achieve compliance with ASC 842, GASB 87 or IFRS 16 requirements.

The best lease accounting software for most organizations is a comprehensive lease management solution that helps you take control of your lease portfolio and all associated costs and provides a complete, end-to-end system with fast implementation and data migration.

What are the different types of lease software solutions?

There are several types of lease software solutions. Understanding the benefits of each can help you choose the right lease software solution for your business.

1. Lease accounting: Standalone lease accounting software

Lease accounting software helps accounting teams achieve compliance and manage the financial reporting requirements associated with leases by providing capabilities including:

- Aggregation of the data associated with real estate, equipment, vehicles, land and any other leases the organization holds

- Configuration of lease data to align with the organization’s financial accounting systems

- Aggregation, calculation and reporting of ROU assets, interest expenses, liabilities and other financial elements required under FASB, GASB and IASB guidance

2. Lease management: All-in-one lease accounting and lease administration

A cross-functional lease management software provides full lease accounting capabilities along with lease administration function for day-to-day management of an organization’s lease portfolio. This type of all-in-one software provides a single integrated source for accurate and up-to-date lease data.

By providing the tools for tracking and managing lease data on an ongoing basis, a complete lease management system:

- Maintains up-to-date data for generating accurate lease accounting calculations and reporting

- Provides checks and balances in the system’s lease accounting functions

- Alerts you to important dates and events, such as lease renewals, end dates, payment increases and opt in/out deadlines

- Uncovers location-level expenses, business risks and possible opportunities to reduce costs

- Reduces or eliminates auditing risks

- Aids in achieving initial compliance and maintaining compliance for the long term

Not sure which solution to choose? Download the guide Lease Accounting and Lease Administration Software: Why You Need Both.

See how easy lease

optimization can be.

See How