Don't Select A System Without Considering These Factors…

Choosing the right lease accounting software is a critical decision for all businesses. With so many options available, it’s important to evaluate the factors that matter most to your organization. Choosing the right software will save you time and money in the long run and increase ROI. In this article, we’ll discuss key considerations that will help you get everything you need from a lease accounting system.

1. The Benefits of a Single System

Some accounting leaders may assume the easiest way to get the calculations they need is to purchase a simple standalone lease accounting tool and feed it with data from other systems or repositories (such as spreadsheets, or a lease management point solution).

That approach rarely proves as fast or easy as you expect. For one thing, your lease data probably resides in numerous systems: real estate may have their own point solution, procurement may have spreadsheets with IT equipment data, and many leased assets are still in a PDF on somebody’s computer! Aggregating all that information is complex and requires some manual intervention to ensure data integrity.

Benefits of a Unified Platform

Without all of the data residing in one place and serving as your “single source of truth,” you’ll face a time-consuming data validation process to ensure information is consistent and not duplicative. And don’t forget, you’ll need to repeat this process on Day 2 to ensure data is synced and your reporting is valid and accurate.

Selecting a single platform that performs both administrative and accounting functions can allow you to skip secondary data validation and ongoing integration costs. Don’t make the mistake of overlooking the long term benefits that a single system can provide:

- It can help you manage your policies with respect to options and contingent/variable rent obligations

- It can provide the strategic business intelligence needed to shape short and long term real estate decisions to support business needs while reducing occupancy expenses

- It can directly identify and correct costly payment mistakes.

2. Price and Value

Understanding Implementation Costs

While we’re on the subject of costs, it’s important to understand that there are one-time expenses associated with implementing a lease accounting system. These may include project management, lease abstraction, data collection and the implementation cost for the lease accounting system.

Comparing Software Prices

Be sure to consider these costs when comparing prices for solutions. Some will cost a great deal more to implement than others. Software license prices can also vary widely. Never rush into a contract (especially a long term one) without digging deep enough into the functionality to understand the value you’re going to get for the price. Ask yourself:

3. How You’ll Get Data into the Lease Accounting Tool

The simplicity (or complexity) of getting your data into your chosen lease accounting tool is probably the biggest factor impacting how fast your company can make the transition to your new system. Before choosing a system, ask these questions to understand the process, resources and time required for this all-important task:

- Will you need to pay an external consultant to manage the process, or is the vendor willing and able to help you manage it?

- Does the vendor have enough lease expertise to help you manage data collection and abstraction? If consultants are needed, it’s important to understand total costs and project duration.

- Is data migration automated, manual or a hybrid?

Bulk-Upload Capabilities

It’s essential to have bulk-upload capabilities to speed the population of both quantitative and qualitative data. However, relying entirely on automated data entry, especially for complex real estate lease information, will result in data integrity problems. The system you choose should easily accommodate both manual and automated data entry, and the process must include quality checks throughout.

Does the vendor provide data migration tools and implementation instructions?

You should expect collecting and validating all your lease data to be challenging, but migrating it into the new system should be straightforward. Migration tools and clear implementation instructions show the vendor’s level of expertise with the process.

What kind of implementation support can you expect from your accounting partners?

Will they act as an advisory arm to help you with data collection and cleansing as well as policy decisions? Many accounting and consulting firms are providing clients with a repository database where you can aggregate data and validate before importing in your lease accounting system. Some companies also offer implementation services for their clients to take the stress off their business during the transition.

4. Integration With Your Existing Systems

Every vendor says their product integrates with other systems. However, to be sure you’ll get the results you expect, it’s up to you to investigate the depth and details of the integration. You may want the data from your lease accounting system to feed multiple tools and enterprise systems.

Key Integration Capabilities

Many organizations (especially multinational organizations and those with multiple subsidiaries) will need the following integration capabilities:

Ability to create journal entries, including multiple GLs

Ability to create journal entries, including multiple GLs- Ability to integrate with common ERP and AP systems, such as SAP & Oracle

- Flexible APIs and XML capabilities for unique integrations

- Integration with modern communication platforms, from Outlook to Slack, for alerting users about critical events and actions

- Ability to feed business intelligence systems that provide high-level dashboards for the C-suite

- Ability to bolt onto an IWMS or lease administration system to add seamless lease accounting functionality to a legacy database

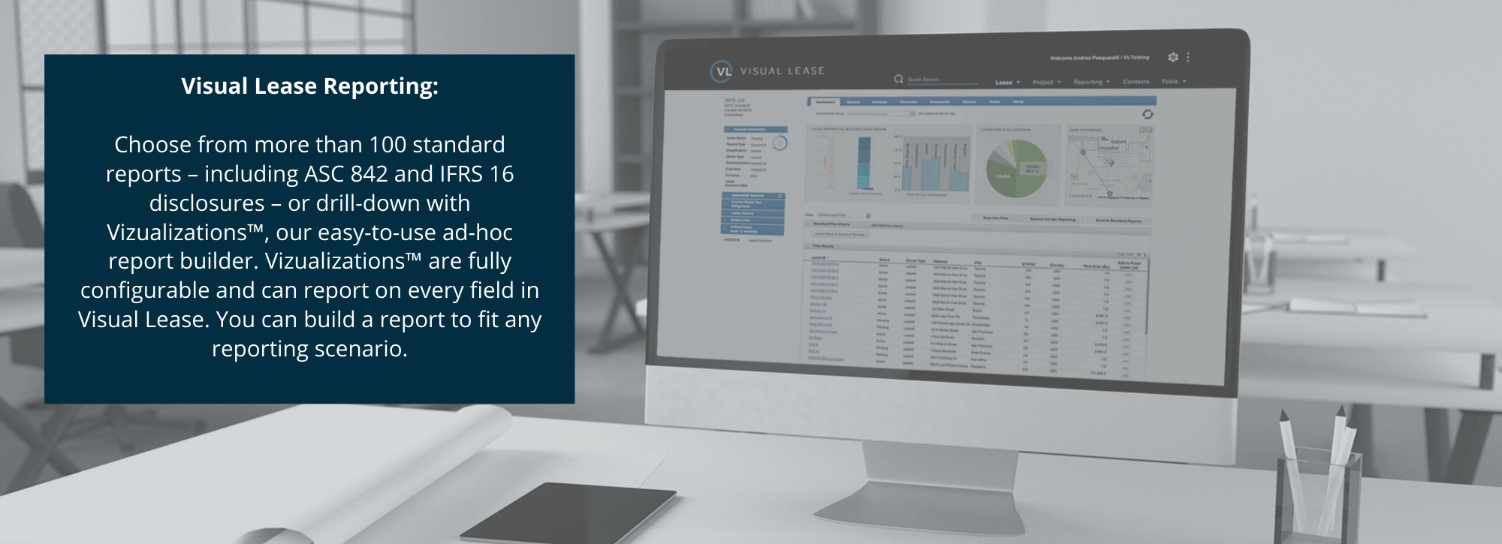

5. Drill-Down Reporting Capabilities

At the end of the day, you need your lease accounting system to provide essential reports with reliable data and accurate calculations. Equally important is the flexibility to customize these reports to suit your organization’s needs. having a system that allows you to generate and adjust reports without constantly relying on external support can save time and reduce costs.

Customizing and Analyzing Data

To get the most benefit from your lease accounting system, you’ll want the ability to easily “slice and dice” financial data in unlimited ways. We’re talking about customizing reports according to your terminology, reporting schedule and business practices. There are many situations where you’ll want the ability to easily create ad-hoc and drilldown reports, or make adjustments to predefined reports, such as

- Fiscal year or quarterly reports

- Drilling down into expense obligations by region, organization, cost center, asset type and other variables

- Performing currency conversion and analyses

- Evaluating KPIs and metrics for fixed assets

Being forced to lean on the vendor or a consultant every time you need an adjustment or new report will not only slow you down, but also add considerably to the cost of using the system.

6. Security and Data Protection

Your lease data contains sensitive financial information, contractual terms, and sometimes personal information, all of which need to be protected from unauthorized access. A good lease accounting system should offer advanced data security features.

Crucial Data Security Features

There are many data security features to consider when comparing lease management softwares. The following are some of the data security features we feel are a necessity for all companies:

- Physical Security of Servers: Ensure the software provider’s servers are housed in secure, access-controlled data centers with 24/7 monitoring to prevent unauthorized physical access to your data.

- Data Encryption

- Data Encryption: Look for software that uses data encryption to protect your data during transmission and while at rest, ensuring that sensitive information remains secure from unauthorized users.

- User Authentication: Multi-factor authentication and strong password policies should be implemented to verify user identity, reducing the risk of unauthorized access to the system.

- IP Whitelisting: This feature limits access to your lease accounting system by allowing only approved IP addresses to connect, adding an extra layer of security to protect against external threats.

- User Roles and Permissions: Ensure the software allows you to assign different roles and permissions, so only authorized users can access, view, or modify specific data, ensuring data integrity and security.

7. Your Plan for Day 2

These are some key factors that will impact how well your lease accounting system works for you, Post-implementation.

User Experience

At this stage of the game when you’re primarily concerned with getting data into and out of a lease accounting system, you may not take a close look at how easy (or difficult) it is to work within it. After you go live, this becomes a much bigger issue.

- Leases change regularly and need to be updated. How many screens will you have to wade through to find the field to modify?

- Is information entered once and used throughout, or entered in multiple places, resulting in data integrity problems?

- How easy is it to produce quarterly and annual reports?

- Will you need to hire experts or invest a lot of time and money in training every time you add new users?

Flexibility.

There’s no such thing as a cookie-cutter company. It’s virtually certain that you’ll want to make changes to any lease accounting system so that it operates according to the way you do business. At a minimum, you’ll want the system to accommodate your fiscal calendar and reporting schedule. You may work with multiple currencies. You may need to adjust interest rates depending on asset type, useful life or location, or have the ability to override global rules (related to discount rates or capital/operating lease tests, for example). How easy is it to make those changes? If those things are difficult or impossible, imagine what you’ll go through to make major changes to accommodate an acquisition or a reorganization. Easy configurability is not a nice-to-have, it’s a necessity

Audit Support.

During an audit, the last thing you want is to be scrambling to answer questions about how numbers were calculated and the details of policy decisions. Your lease accounting system should provide easy access to supporting data behind FASB quantitative and qualitative disclosures via drill-down capabilities.

Selecting lease accounting software is not just about finding a solution that works for today—it’s about choosing a platform that can grow with your business. Choosing a premium lease accounting software, like Visual Lease’s platform, ensures that your business can stay compliant with lease accounting standards, and have a more organized and efficient lease management system. Don’t rush the decision— consider these seven things and evaluate your options thoroughly to ensure the software you choose meets your current needs and future goals.

About Visual Lease

Visual Lease is a leading provider of lease accounting and lease administration software. Our software will help get your organization compliant with ASC 842 and IFRS 16 requirements. The Visual Lease platform also provides and easy-to-use Day 2 solution with its lease management capabilities and infrastructure. The system enables organizations to quickly and easily manage their lease portfolios, define and track specific lease clauses, proactively manage critical dates (such as renewal options), and visualize your asset portfolio! Request a demo of Visual Lease today

Ability to create

Ability to create