There is power within your lease portfolio. Over the last year, public and private businesses have taken a closer look at their leases – and experienced the downstream benefits of…

There is power within your lease portfolio. Over the last year, public and private businesses have taken a closer look at their leases – and experienced the downstream benefits of…

This article originally appeared here in Forbes. As a result of Covid-19 and the changing landscape related to leases, private companies have received more time to prepare for and adopt…

This article originally appeared here in Forbes. In 2020, many companies were forced to make tough decisions regarding their leased commercial spaces. From office closures to consolidations and deferrals, many…

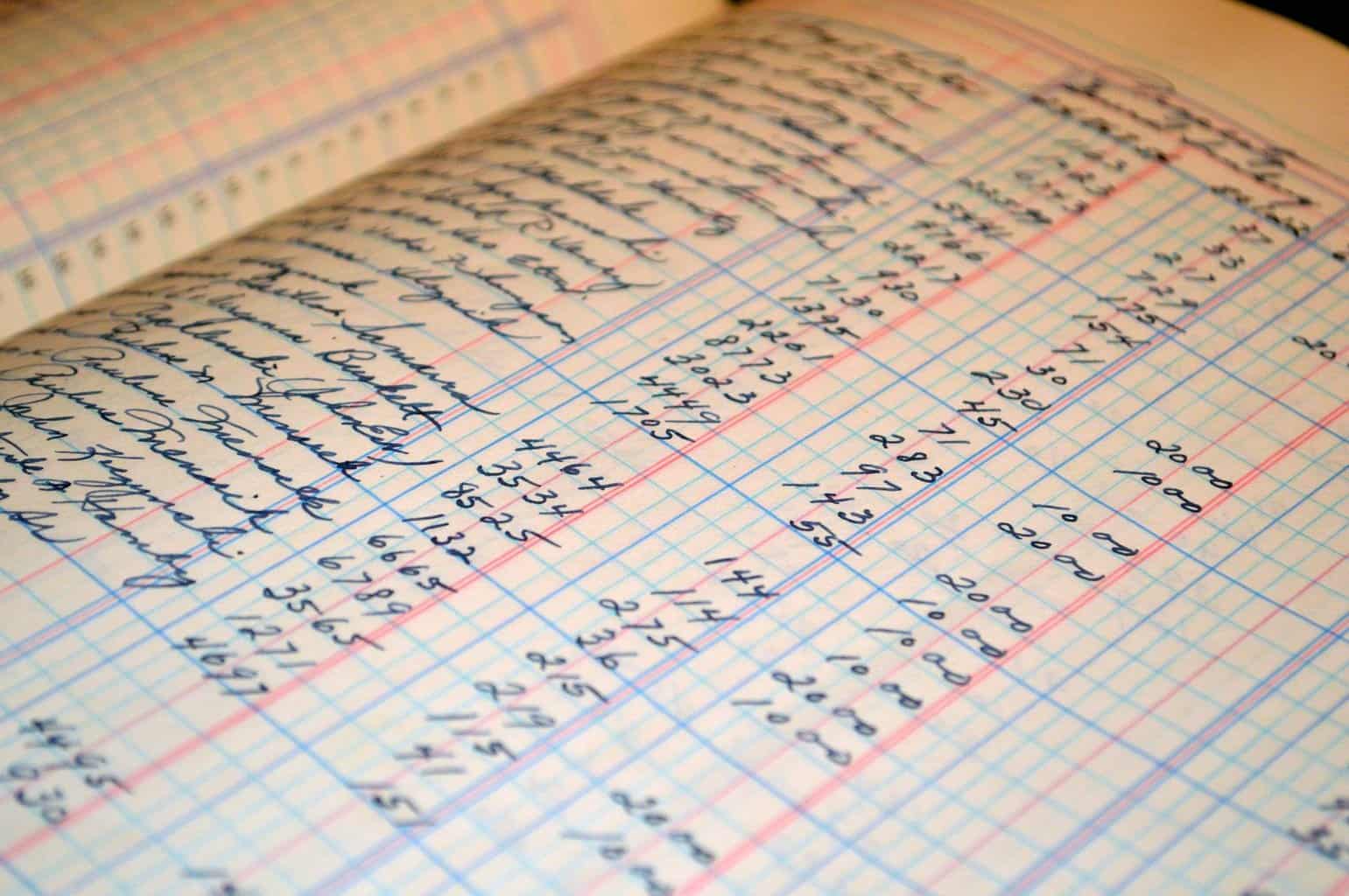

Lease accounting (ASC 842, IFRS 16 or GASB 87) is not your average one-and-done disclosure. This whole new approach to accounting requires you to account for lease changes throughout the year with a higher level of scrutiny. A…

Organizations are increasingly seeking flexible lease options, with short-term leases becoming more popular. Lease accounting standards treat different lease lengths differently. This blog explains the ASC 842 requirements for accounting…

Changes in accounting standards have made lease accounting more difficult. Adopting IFRS 16 lease accounting, for example, has made compliance cumbersome as it involves adjusting to new policies, systems and…

Beginning in 2006, there was a concerted effort by the two accounting standard bodies (FASB and IASB) to synchronize their respective standards on leasing to assure consistency and uniformity. The…