The new lease accounting standards, ASC 842 and IFRS 16, bring greater visibility into corporate lease obligations. For many companies worldwide, the impact on their balance sheet is expected to grow significantly. In fact, overall balance sheets could increase by as much as $2 trillion due to the accounting change, according to the Wall Street Journal.

Although the new lease accounting rules have affected the balance sheets for many companies, will they also impact business valuations? How have private companies, which have transitioned since December 15, 2021, to the new ASC 842 standards, been affected?

In this article, we’ll look at the true impact ASC 842 and IFRS 16 have on lease liability.

How to do lease liability calculations

Under the new lease liability calculation rules, there are a number of assumptions you need to make. These include:

- The lease’s residual value guarantee

- Any rights to exercise options for renewal, termination, or purchase

The residual value guarantee — the estimated fair value of the lease upon termination — and additional options are used as an estimate of probable amounts owed.

Calculating present value of future payments

Using these assumptions, you need to calculate the present value of the minimum future lease payments. The discount rate can be the rate implicit in the lease, which is the rate where lease payments and unguaranteed residual value are equal to the fair value of the asset and its associated costs for the lessor.

If the implicit rate isn’t known, you can use your organization’s incremental borrowing rate (IBR). According to IASB, IBR is the rate that the lessee could realistically borrow the funds necessary for a similar asset under similar terms.

Changes for Periodic Remeasurements for Lease Liabilities

These lease liability calculations will need to be remeasured periodically, as the assumptions you make at the inception of a lease often change over time. Not only might the rate or payment estimates vary, but the lease agreement itself could change due to abandonments, asset impairments, and other modifications.

You’ll likely need to perform these calculations for nearly all of your leases, even if they were previously considered operating leases…

Under the new lease accounting standards, nearly all leases must be brought onto the balance sheet with ROU asset and liability calculations.

What is a Right of Use (ROU) Asset?

For a lessee, a right-of-use or right-to-use lease asset is defined as the lessee’s right to occupy, operate or hold a leased asset legally owned by another party during a specific lease term. The new standards require you to record the actual right-to-use of the asset (i.e. the right to use a cargo truck) rather than the actual asset (i.e. the cargo truck itself). This means that the right-of-use asset is an intangible asset.

How to Calculate ROU for Leases?

The ROU asset is calculated starting from the initial liability of the lease, plus initial direct costs, plus prepaid (or accrued) lease payments, less any lease incentives received.

Written as a formula, this is how to calculate an ROU asset:

Right-of-use (ROU) asset =

Lease liability present value of lease payments not yet paid at that date

+ initial direct costs incurred by lessee

+ or – any lease payments made at or before commencement date

– applicable lease incentives received

Example of Lease Liabilities on a Balance Sheet

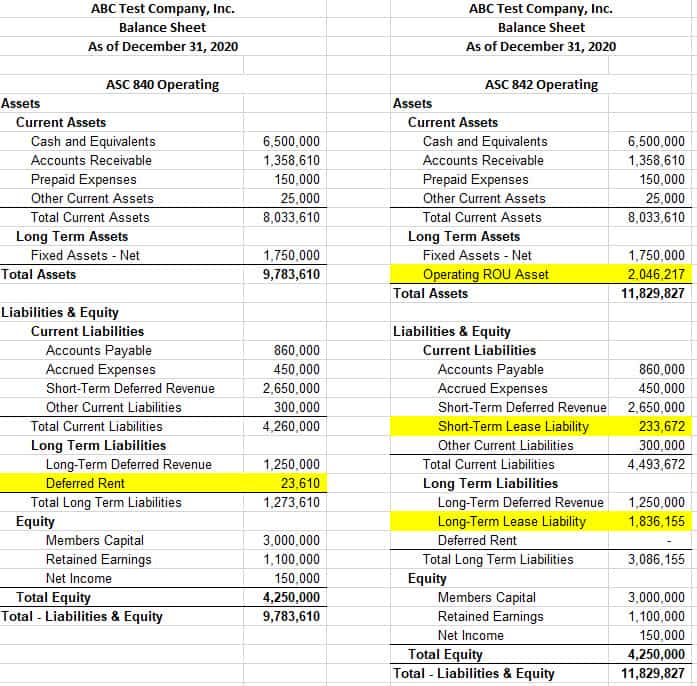

As stated above, accounting for leases under ASC 842 will likely have a material impact on your balance sheet going forward.

In the past, operating leases were unrecorded liabilities, and the only accounts that appeared on balance sheets for these were prepaid or deferred rent.

But now all operating leases except for short-term leases must be capitalized on the balance sheet. This is the most significant change under ASC 842, and one of the most substantial changes to accounting rules in decades.

This is a 7-year real estate lease that, under the old rules, was classified as an operating lease. In the current accounting period (see above), the deferred rent balance of $23,610 is small in comparison to Total Assets of $9.8 million and Total Liabilities of $5.5 million. Notice that there’s no visibility into the nearly $2.5 million future obligation under this lease.

Example of Changes in Lease Liability Reporting

Under ASC 842, however, the impact is substantial. Using a discount rate of 5%, the present value of future payments is almost $2.3 million. This brings the Total Assets for the accounting period to $11.8 million, and Total Liabilities to $7.6 million. With no difference on the P&L between calculations, we’ve made $324,000 in lease payments, yet only reduced the lease liability on the balance sheet by $216,000.

Keep in mind that this is just one lease among a potentially large portfolio of leases for real estate, equipment, and more. As you can imagine, these changes will significantly inflate balance sheets and could potentially impact the comparability of business valuations in the short-term.

Performing Lease Accounting Calculations

When you have multiple leases, it’s very challenging to manage the calculations required under the new lease accounting rules for each reporting period, especially if you’re using Excel spreadsheets. “Making the switch to lease accounting software is critical to automate lease liability calculations and ease the transition to the new standards for your business.

Lease accounting software providers, like Visual Lease, ensure you’re compliant with the latest lease changes while easing the burden on your accounting team in terms of:

- Managing your lease portfolio

- Calculating lease liabilities

- Meeting your reporting requirements

Take the stress out of lease liabilities by contacting our team of experts today. Visual Lease makes it simple to streamline your lease liability calculations and ditch your Excel spreadsheets.

If you want to see for yourself how Visual Lease can streamline your lease liability calculations, schedule a free demo now.