The old lease standard, ASC 840, did not require all kinds of leases to be recorded on the balance sheet, which in turn provided the opportunity for many to use off-balance-sheet financing. This all changed with the release of the new lease standard, ASC 842, requiring all leases to be reflected on the balance sheet.

The change raises different questions such as the amount to be recorded as a lease liability and lease asset. Different factors affect the amount of liability and discount rate. There are also various factors such as prepayment, initial direct costs, and prepayments that impact the right-of-use cash flow statement.

Below are the concepts you need to better understand right-of-use asset rules under ASC 842. (This is especially critical for private companies that are new to ASC 842 and must transition to the standard by their organization’s effective date as of December 15, 2021)

What is a right of use asset?

A right-of-use asset, also known as an ROU asset, pertains to the lessee’s right to occupy, operate, or hold a leased asset during the rental period. In the old lease standard, an asset, for example, a cargo truck, would be recorded straight to the balance sheet.

Right-of-use asset (ROU) under ASC 842

ASC 842 Lease Accounting Standard requires the recording of the actual right-to-use of the asset (such as the cargo truck) rather than the actual asset. This means that the right-of-use asset is an intangible asset.

How do you determine lease liability?

Lease liability is the financial obligation for the payments required by a lease, discounted to present value. Recording the lease liability on a company’s balance sheet requires you to determine the lease term and lease payment. You must also know the rate to be used in discounting the lease liability. Under ASC 842, initial operating lease liabilities and finance lease liabilities are calculated using the same method.

The lease liability pertains to the obligation to make the rental payments using the present value of the future rental payment. Once the company has determined all the information needed such as the lease payment, lease term, and discount rate, then the liability can be discounted over the lease period using the discount rate.

The resulting amount becomes the lease liability and is recorded on the balance sheet. Now, the company has to proceed with recording the leased asset.

What is included in a ROU asset?

A right-of-use asset, or ROU asset, is a key component of lease accounting under accounting standards such as ASC 842 and IFRS 16. The right-of-use asset encompasses several components, including:

- Lease Liability: The lease liability represents the present value of the lessee’s future lease payments. It is recognized on the balance sheet as a liability associated with the lease agreement. It incorporates the total lease payments over the lease term, including fixed payments, variable payments based on an index or rate, and any residual value guarantees

- Initial Direct Costs: Initial direct costs incurred by the lessee in obtaining a lease are included in the right-of-use asset. These costs may include fees for legal services, commissions, and other directly attributable costs incurred to secure the lease.

- Lease Incentives: Reimbursement or payment provided to the lessee or made on their behalf. It can also refer to losses the lessor takes on when they assume a lessee’s existing lease with another party.

How to calculate right of use assets under ASC 842

Calculating right-of-use assets under ASC 842 involves several steps. Here’s a general overview of the process:

Identify Lease Contracts

Determine which lease contracts fall under the scope of ASC 842. Leases with a term of 12 months or less and leases of low-value assets may have specific exemptions.

Record Lease Liability

Calculate the present value of future lease payments and record the lease liability on the balance sheet. This requires determining the lease term, discount rate, and lease payments (including any variable payments, residual value guarantees, and lease term options).

Determine the Initial Right-of-Use Asset

The initial right-of-use asset is typically equal to the lease liability, adjusted for any lease payments made before or at the lease commencement date, initial direct costs, and any lease incentives received.

Account for Lease Payments

Recognize and allocate lease payments between reducing the lease liability and accounting for interest expense. This involves applying the effective interest method to calculate interest expense over the lease term.

Adjust for Lease Modifications

If there are any modifications to the lease contract during its term, such as lease extensions or changes in lease terms, reassess the lease liability and right-of-use asset based on the updated terms.

Assess Impairment

Periodically review the right-of-use asset for impairment, considering factors such as changes in the expected lease term, the occurrence of triggering events, or a decline in the asset’s value.

It’s important to note that the specific calculations and considerations may vary depending on the complexity of lease agreements and individual circumstances.

What is an initial direct cost?

Initial direct cost is defined as the “incremental costs of a lease that would not have been incurred had the lease not been obtained.”

For example, a broker’s commission paid by the business would be an initial direct cost since this payment was only made because the lease has been obtained. Similarly, a payment made to the current tenant as an incentive to end the present lease contract would likely be classified as an initial direct cost because this cost was incurred since the new lease contract was signed.

On the other hand, payment for a lawyer’s fees for obtaining legal or tax advice may not be considered as an initial direct cost because the services of the lawyer were not the result of having obtained the lease.

What is a Lease Incentive and Lease Prepayment?

A lease incentive is an incentive provided by the lessor to attract the tenant to secure a lease contract. This incentive may be provided in different forms such as payment of the lessee’s costs, an up-front cash payment, or the assumption of the lessee’s current lease.

A lease prepayment, as its name suggests, is a payment given in advance.

Example: Calculating a ROU Asset Under ASC 842

Before we look at the numbers, it’s helpful to see how ASC 842 applies in practice. The following example walks through the steps to calculate both a lease liability and an ROU asset. By working through the assumptions, present value calculation, and journal entries, you can see how these balances appear on the balance sheet and why accurate lease accounting is essential for compliance.

Scenario

- Six-year rental period without renewal options

- $40,000 lease payment required at the end of each year

- The right-of-use asset is increased by 9% (the incremental borrowing rate)

- Initial direct cost is at $2,000

Step 1: Calculate the Lease Liability (Present Value of Payments)

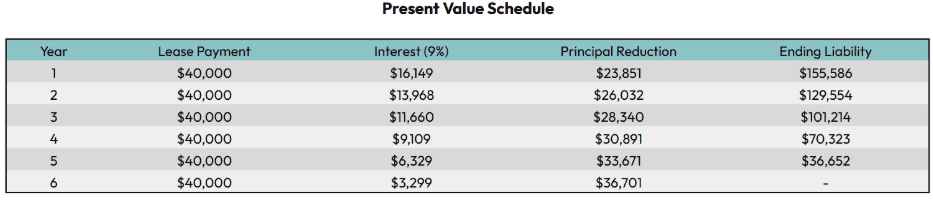

| Year | Lease Payment | Interest (9%) | Principal Reduction | Ending Liability |

| 1 | 40,000 | 16,149 | 23,851 | 155,586 |

| 2 | 40,000 | 13,968 | 26,032 | 129,554 |

| 3 | 40,000 | 11,660 | 28,340 | 101,214 |

| 4 | 40,000 | 9,109 | 30,891 | 70,323 |

| 5 | 40,000 | 6,329 | 33,671 | 36,652 |

| 6 | 40,000 | 3,299 | 36,701 | – |

Present Value of Payments (Lease Liability): $179,437

Step 2: Calculate the ROU Asset

ROU Asset = Lease Liability + Initial Direct Costs + Prepayments – Incentives

= $179,437 + $2,000 + $0 – $0

= $181,437

Step 3: Journal Entries

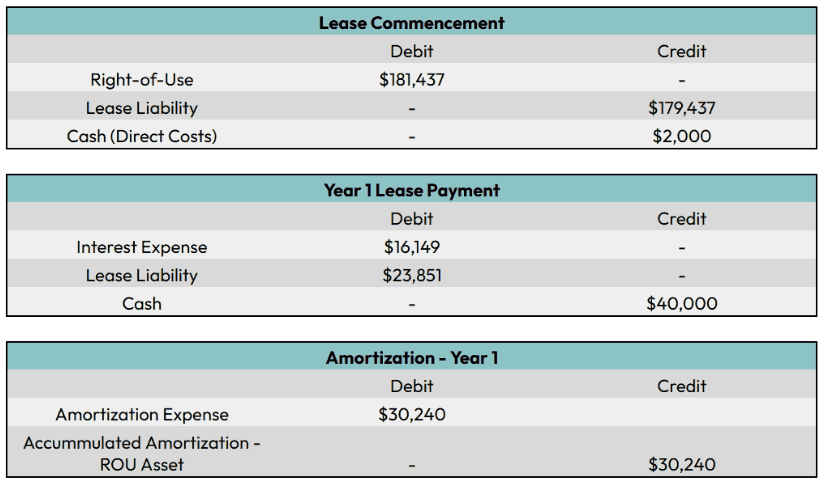

At Lease Commencement:

- Debit ROU Asset: $181,437

- Credit Lease Liability: $179,437

- Credit Cash: $2,000

At End of Year 1 (Lease Payment):

- Debit Interest Expense: $16,149

- Debit Lease Liability: $23,851

- Credit Cash: $40,000

Amortization of ROU Asset (Finance Lease, Year 1):

- Debit Amortization Expense: $30,240

- Credit Accumulated Amortization – ROU Asset: $30,240

Journal Entry Flow

Simplify Your ROU and Lease Liability Calculations

In the end, computing for the lease liability and the right-of-use asset isn’t that complicated, but one has to deal with the tricky task of gathering data.

Thus, businesses must ensure that they obtain reliable data to ensure the correct figures of the lease payments, lease term, and discount rate. It also helps to have reliable lease accounting software for proper accounting and record entry of right-of-use assets. Contact Visual Lease today for a simplified lease accounting process.

Form more information on how Visual Lease can help your business evaluate your leases, reach out to us today

ROU asset FAQs

What is an ROU asset under ASC 842?

An ROU asset represents your organization’s legal right to use leased property or equipment for the lease term. Under ASC 842, both operating and finance leases require recognition of an ROU asset on the balance sheet, ensuring that stakeholders can see the true scope of your lease obligations.

How are lease liabilities measured under ASC 842?

Lease liabilities are calculated as the present value of lease payments your organization is obligated to make over the lease term. To discount those payments, you use either the rate implicit in the lease (if known) or your incremental borrowing rate. This process ensures your financial statements reflect the real economic impact of your leases.

What is the difference between an ROU asset and a lease liability?

The ROU asset reflects the benefit of having access to the leased asset, while the lease liability shows the obligation to make payments for that use. Together, they create a more accurate picture of your lease portfolio’s impact on financial performance and compliance under ASC 842.

How does ASC 842 affect the balance sheet?

ASC 842 requires nearly all leases to be recorded on the balance sheet. This means recognizing both an ROU asset and a corresponding lease liability, even for many operating leases. As a result, organizations gain greater transparency into their lease portfolio, helping reduce financial risk and improving compliance.

What disclosures are required for ROU assets and lease liabilities?

ASC 842 mandates both qualitative and quantitative disclosures, including information about lease terms, discount rates, maturity analysis of lease payments, and details on lease expense. These disclosures provide stakeholders with the clarity they need to understand how leases affect your organization’s financial health.

How are ROU assets amortized under ASC 842?

The amortization of an ROU asset depends on whether the lease is classified as operating or finance. For finance leases, amortization is typically straight-line over the lease term. For operating leases, the expense is recorded as a single lease cost, effectively spreading the ROU asset’s amortization along with interest on the liability.

Why are ROU assets and lease liabilities important to financial reporting?

Recognizing ROU assets and lease liabilities creates transparency in financial reporting by showing the full scope of lease commitments. This visibility helps stakeholders better evaluate risk, supports compliance with ASC 842, and allows organizations to use lease data as a strategic asset for smarter financial decision-making.

Right of Use Asset & Lease Liability on the Balance Sheet

Calculating the right-of-use amortization requires examining three items closely: