See how Visual Lease gives you the control and confidence you need within your lease portfolio to stay audit-ready all year long, while turning your leases into a strategic asset.

ASC 842 Leases on the Balance Sheet.

The FASB lease accounting standard ASC 842 requires organizations to account for leases as right-of-use assets and liabilities on the balance sheet.

This isn’t just a one-and-done disclosure, it’s a whole new approach to accounting (and an ongoing process).

Get the controls you need to stay compliant and lead to a real ROI.

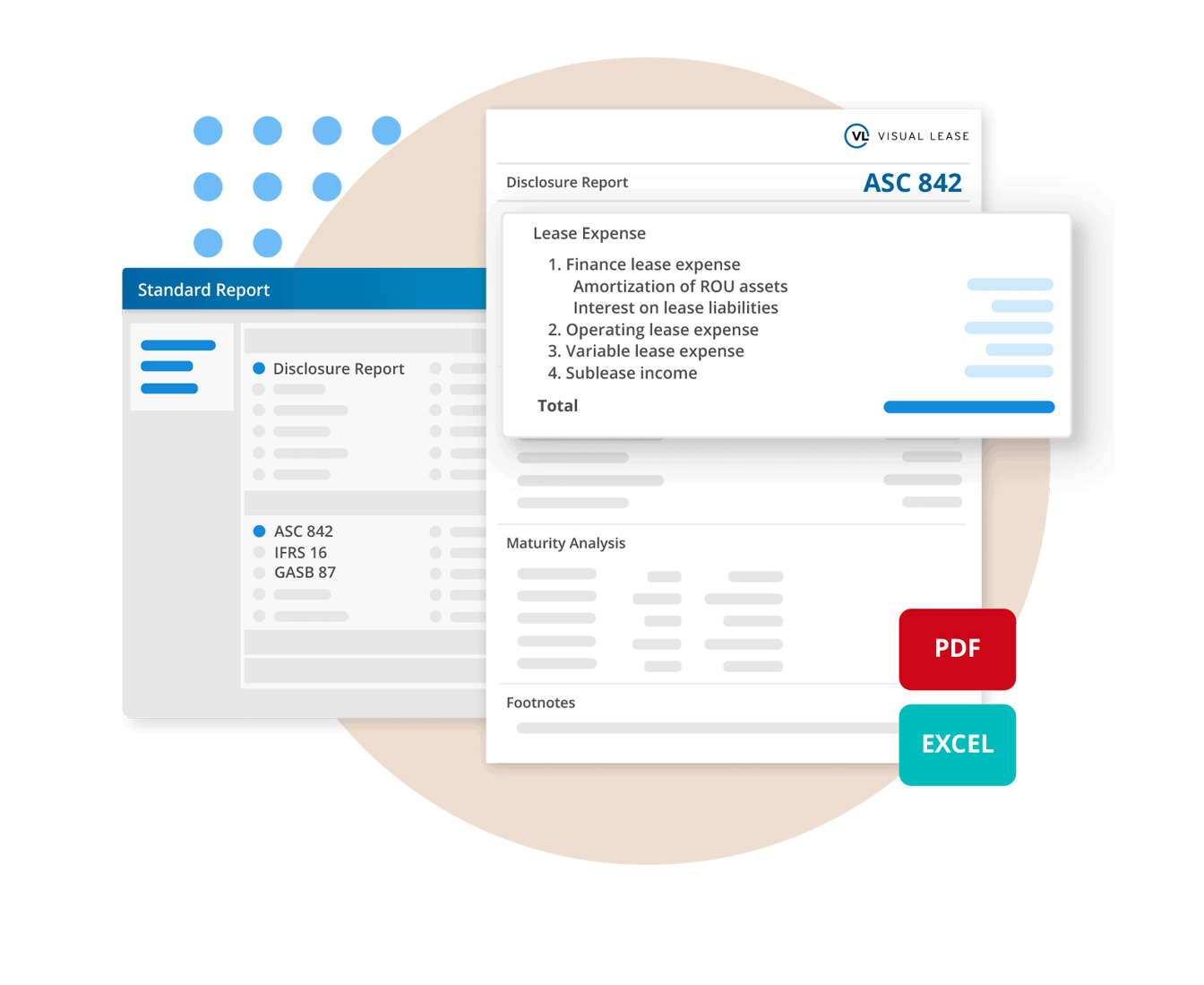

Generate ASC 842 journal entries, disclosures, reports and footnotes required to transition to the new lease accounting standards.

Manage every modification and maintain compliance for day 2 and beyond – even as your leases and the regulatory requirements evolve.

Centralize your leases in a single subledger and unlock insights, efficiencies and savings across your leased assets.

Account for all your leases in a single subledger.

Ongoing compliance starts with reliable data.

See all your leases in one place with a single subledger and account for every clause and obligation, including master leases, subleases, embedded leases and special scenarios in real estate or any other leased asset.

Learn more about lease types you need to account for

Automate auditability with accurate reports.

Built by lease accounting experts, explore our wide selection of one-click report templates with the ability to perform comprehensive calculations backed by SOC I Type II certification. Or, configure one-off reports with our powerful ad-hoc reporting engine.

Maintain ASC 842 compliance through every modification.

When leases change, your lease accounting software needs to keep up. Stay audit-ready with robust software that can handle complicated remeasurements with simple formulas.

Trace all changes with an inclusive audit trail and ensure all actions are following protocol with comprehensive internal controls.

Learn more about accounting for remeasurements

Lease Accounting Software Loved by leaders

More than 1,500 companies trust Visual Lease with their lease portfolio.

And 99% renew their contract every year.

ASC 842 Software: Configurability that feels customized.

Every business has unique processes, especially when it comes to leases. Our solutions are highly configurable, enabling a seamless fit to your business practices and an intuitive experience for your users.

Take control of your data and set up the system any way you want with complete configurability, without the headache of custom code.

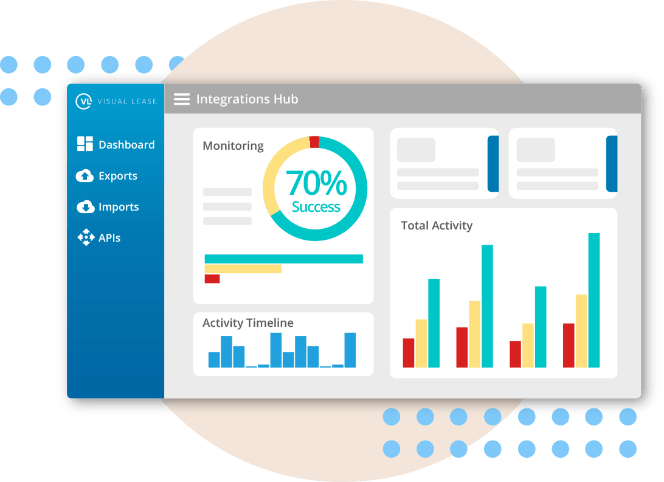

Integrations to truly stack

your tech.

Align every line in your general ledger and leverage lease data across your organization with secure, auditable file transfers and flexible APIs to connect every system.

Seamlessly connect your ERP and import journal entries into your general ledger, or track rent payments within accounts payable.

Learn more about integrations

Expert advice at every stage.

Every implementation gets a dedicated team to help you get up to speed, get compliant, and get the most out of our software in 90 days or less.

Once you’re up and running, our team of experienced accountants, attorneys, and lease managers is here to help as your leases – and the regulatory requirements – evolve.

ASC 842 Frequently Asked Questions

What is ASC 842?

ASC 842 is a lease accounting standard that was released by the Financial Accounting Standards Board (FASB) that replaces ASC 840. The standard was put in place to increase disclosure and visibility into leasing obligations for both private and public sectors. Previously, most leases were left off balance sheets, whereas now companies need to report right-of-use (ROU) assets and liabilities on almost all balance sheets.

When was the ASC 842 effective date?

The ASC 842 effective date differs for public and private companies. Public companies were expected to comply for fiscal years beginning after December 15, 2018. For private companies, the new standard took effect for fiscal years beginning after December 15, 2021.

How does my organization become ASC 842 compliant?

Becoming ASC 842 compliant can be difficult if you don’t have all of your leases readily available. After you have confirmed you have all of your contracts and leases together, making sure that they are placed within your balance sheet correctly is the next step.

We can help skip all of that frustration with our ASC 842 lease accounting software. We can keep all of your ASC 842 leases in one place that will keep you automatically ASC 842 compliant around the clock.

What is ASC 842 implementation for private companies?

There are no main differences between the impact of ASC 842 on public companies versus private. The only difference is the adoption date, which for private companies is fiscal years beginning after December 15, 2021.

Resources to help you get ready

for your lease accounting project

On-Demand Webinar

Lease Accounting Lessons Learned from a Public Company’s Path to ASC 842 Compliance

Read More →