Successful implementation of a leasing management system requires careful planning and execution. Key steps include:

Data Migration and Centralization

Migrate existing lease data from various sources into the new centralized database. This process involves identifying data sources, cleansing and standardizing information, mapping fields to the new system, and importing data.

System Integration

Ensure seamless integration with other business systems such as ERP, accounting, and document management platforms to maximize efficiency and data consistency.

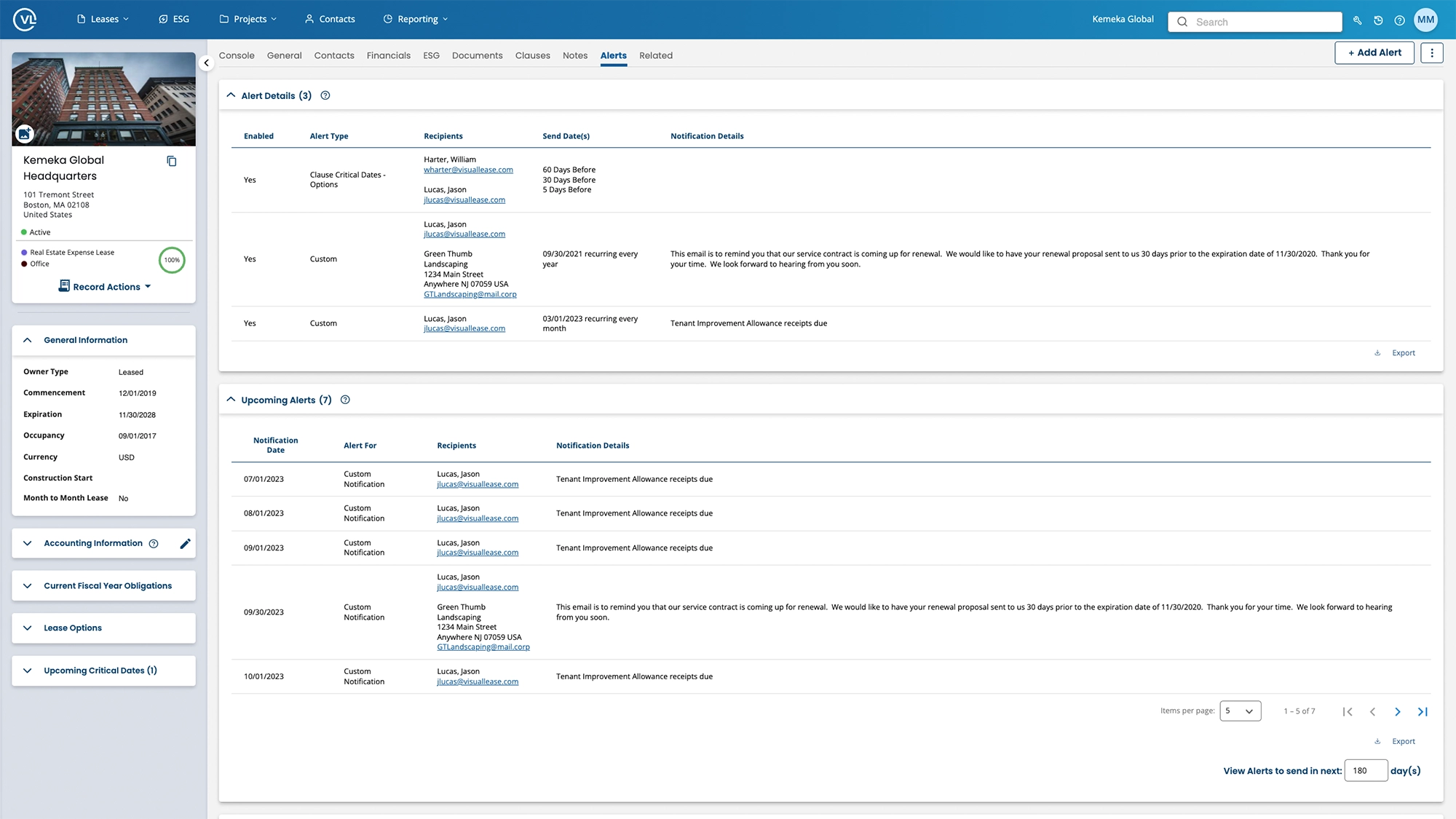

Customization

Configure the system to align with organizational needs, including setting up user roles, customizing workflows, configuring alerts, and creating custom fields and reports.

User Training

Develop comprehensive training materials, conduct hands-on sessions, and provide ongoing support to ensure successful user adoption.

Testing and Validation

Thoroughly test system functionality, validate data accuracy, and conduct user acceptance testing before full transition.

Phased Rollout

Consider a gradual implementation approach, especially for large organizations. This may involve department-by-department rollout or implementing core functionalities first.

By carefully executing these steps, organizations can ensure a smooth transition to their new lease management software, maximizing efficiency and accuracy in lease administration processes.