Reduce the risk of unreliable lease data with Visual Lease’s lease accounting solution. Ensure accurate, timely, sustainable and audit-ready financial reporting and accounting for GASB 87 compliance.

Streamline Lease Accounting for GASB 87 with Powerful, Proven Software

All your leases in a single sub-ledger.

Centralize your leases, surface clauses, obligations, critical effective & implementation dates, and manage changes for any asset you lease (or lease out) all in one place.

This includes real estate, equipment, land, and anything else – on both sides of the transaction – as well as line items you may not have thought of as leases before, like subleases, master leases, embedded leases, and other special scenarios. No matter the situation, our GASB lease accounting software can keep your leases compliant & organized.

Learn more about our software for lessees and lessors

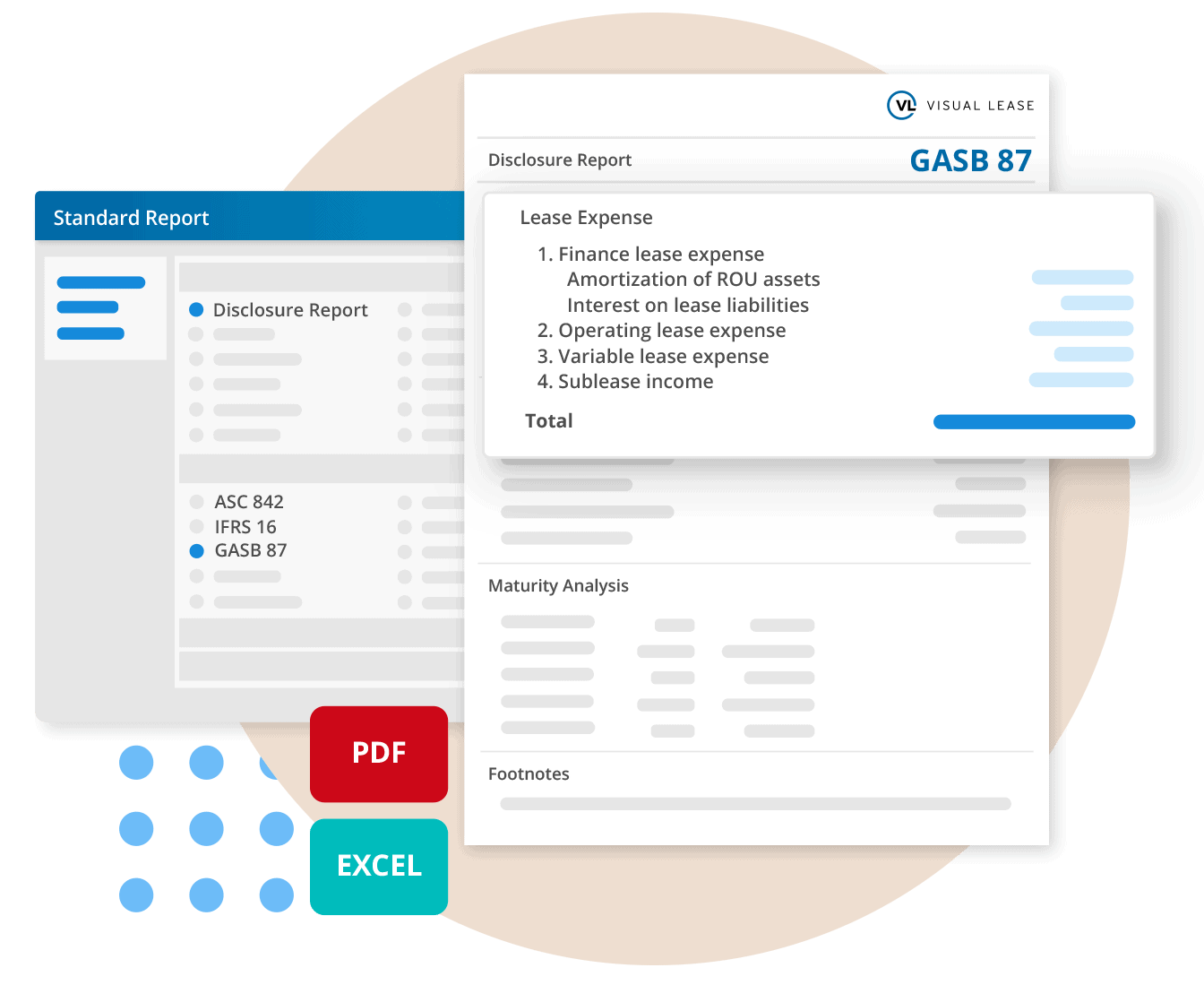

Automate GASB 87 compliance with accurate reports.

Generate the journal entries, disclosures, reports and footnotes you need to stay GASB 87 compliant, automatically.

Leverage our library of one-click report templates built by lease accounting experts with transparent calculations backed by a SOC I Type II certification. Or, set up reports on the fly with our robust ad-hoc reporting engine.

Read up on roll-forward reports

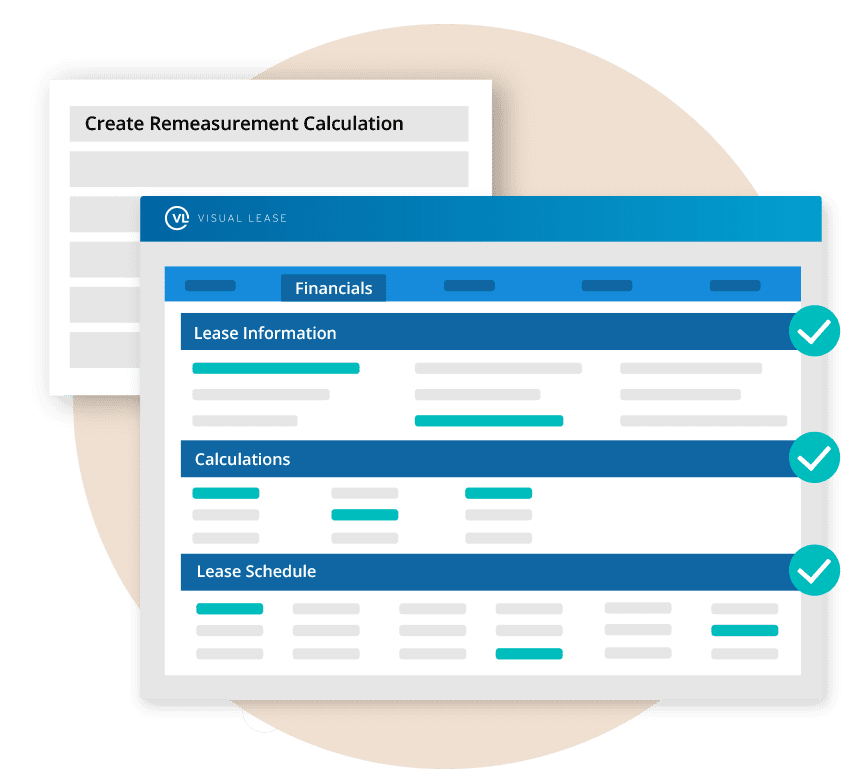

Maintain GASB 87 compliance

through every modification.

Leases change, and so do the requirements. Stay audit-ready with software that can keep up with every lease modification, and manage even the most complex remeasurements with simple calculations.

Track every change with a comprehensive audit trail and make sure every action is by the book with integrated internal controls.

Learn more about lease modifications

Align every line in your

general ledger.

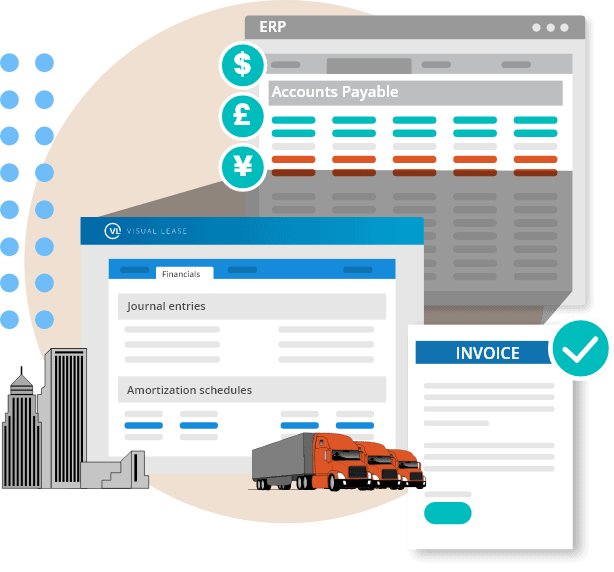

Connect the systems your team relies on and leverage lease data across your organization with secure, auditable file transfers and flexible APIs.

Seamlessly connect your ERP and import journal entries into your general ledger, or track rent payments within accounts payable.

Learn more about integrations

Expert advice at every stage.

Every implementation gets a dedicated Visual Lease team to help you get up to speed, get compliant and get the most out of the VL software in 90 days or less.

Once you’re up and running, our team of experienced accountants, attorneys and lease managers is here to help as your leases – and the regulatory requirements – evolve.

GASB 87 Frequently Asked Questions

What is GASB 87?

GASB 87 was released by the Governmental Accounting Standards Board (GASB) and outlines requirements for lease accounting for governmental entities with significant impacts on financial statements.

GASB 87 provides a single model for lease accounting based on a definition of leases as contracts that convey control of the right to use a non-financial asset. The rules require lessees to recognize a lease liability and an intangible asset, while lessors are required to recognize lease receivables and a deferred inflow of resources on their financial statements.

Who does GASB 87 affect?

GASB 87 impacts government entities and public institutions in higher education, healthcare and more.

GASB 87 does not affect private organizations, for-profit businesses, or entities outside the public sector, including those not required to follow government accounting standards.

When was the effective date for GASB 87?

Organizations were required to become GASB 87 compliant for fiscal periods beginning after June 15, 2021.

How do organizations become GASB 87 compliant?

Implementing GASB 87 can be complex, but Visual Lease can help. There are four things you need to have done before you can successfully be GASB 87 compliant:

- Understand the full extent of your lease portfolio

- Determine the type of leases held by your organization

- Identify & collect all the data points needed for lease calculations

- Implement the new lease accounting methodology

Why is GASB 87 important?

GASB 87 is crucial because it ensures transparency and consistency in how government entities account for leases. It improves financial reporting, making it easier for stakeholders to understand lease obligations and their impact on government budgets. By aligning lease accounting practices, GASB 87 helps public organizations maintain compliance, reduce audit risks, and provide clear, reliable financial data.

What is the difference between GASB 87 and ASC 842?

While both GASB 87 and ASC 842 address lease accounting, the key difference lies in their scope. GASB 87 is designed for government entities and public institutions, focusing on public sector accounting standards, while ASC 842 applies to private sector businesses. Both standards require similar treatments for leases, such as recognizing lease liabilities and assets on the balance sheet, but the reporting and disclosure requirements differ to align with the unique needs of public and private organizations.

What is a GASB 87 journal entry?

A GASB 87 journal entry records the financial impact of a lease under GASB 87 standards. It typically involves two main entries: one for the lease liability and another for the right-of-use asset. When a lease is initiated, the entry records the lease liability as a long-term liability on the balance sheet, along with a corresponding right-of-use asset. Over the lease term, periodic journal entries are made to recognize interest on the lease liability and depreciation of the right-of-use asset. These entries ensure that lease obligations and assets are accurately reflected in the financial statements, helping organizations stay compliant with GASB 87.

Loved by leaders

More than 1,500 organizations trust Visual Lease to account for their leases.