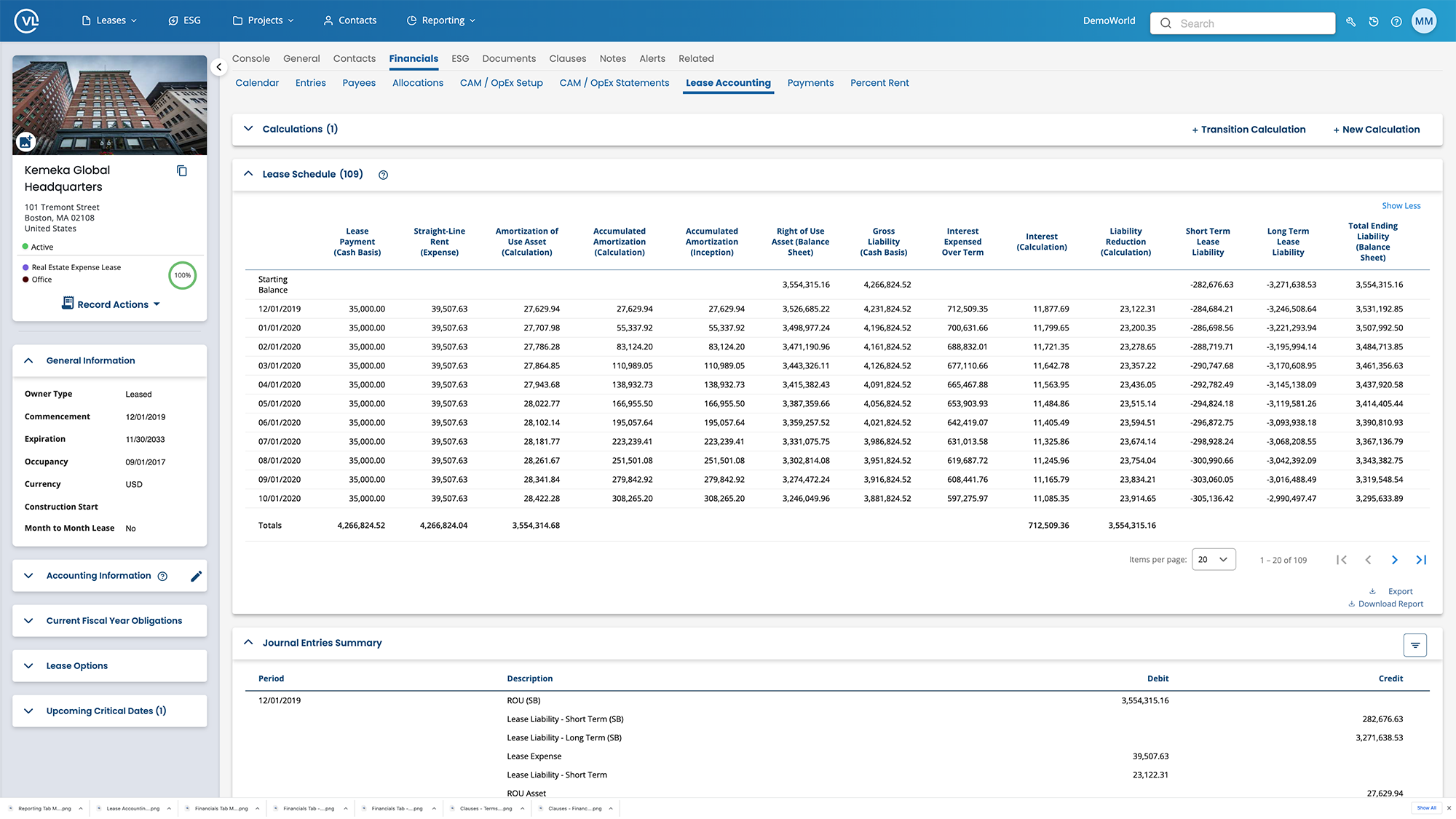

Effortlessly tackle the complexities of lease accounting, ensuring accurate recording, reporting, and compliance with ASC 842, IFRS 16, and GASB 87/96, eliminating the risk of non-compliance penalties. Gain peace of mind with precise financial statements and disclosures that reflect each lease accurately on the balance sheet, income statement, and cash flow statement.

Lease Accounting Software

Transform your financial reporting and simplify GAAP compliance with Visual Lease.

Maximize efficiency and stay ahead of the curve with our powerful, future-ready solution.

Don’t just run the numbers. Rule them.

Take control of your data and disclosures with lease accounting software to simplify month-end close with robust reports. Leverage our library of templates, including one-click roll-forward reports, or configure fields on the fly with our ad-hoc reporting engine.

Be audit-ready all year long

Maintain compliance with simple calculations to handle even the most complex scenarios throughout the lease lifecycle, including modification, impairment, termination, and abandonment. Monitor all changes with a comprehensive audit trail and mitigate risk with integrated approval workflows and access authorizations.

Take control of your lease portfolio and find insights in plain sight

Seamlessly integrate with your existing technology ecosystem through robust APIs, enabling real-time synchronization with leading ERP systems, automated journal entries, and bi-directional data flow with advanced BI tools. Leverage customizable dashboards, predictive analytics, and sustainability insights to inform critical business decisions, optimize operations, and support ESG initiatives across your global organization.

The controls you need to work as one, and get big things done

Centralize your leases with our world-class lease accounting software solution, equipped with purpose-built internal controls to ensure all lease-related activities are properly monitored and managed. Support strategic planning with reliable data that can be used for forecasting and budgeting, ultimately enabling your organization to make informed decisions about its lease portfolio.

Gain confidence in your lease data with these key features.

Automated lease data entry and management

Save time and reduce errors with automated data entry, ensuring accurate and up-to-date lease information.

Lease classification and amortization schedules

Streamline financial reporting and forecasting with accurate lease classification and amortization schedules.

Comprehensive financial reporting and disclosures

Produce detailed, compliant financial reports, enhancing transparency and strategic decision-making.

Integrated with ERP and business intelligence solutions

Ensure data consistency and streamlined workflows with seamless integration into your financial toolset.

Roll-forward reporting

Get validation and visibility into all lease liabilities on the balance sheet over a specified period. View all lease activity with one click, and separate finance and operating leases for ASC 842 journal entry compliance, automatically.

Advanced analytics and reporting tools

Support strategic planning and performance optimization with powerful analytics and customizable reports.

Audit trail and documentation

Simplify audits and enhance accountability with a clear, traceable audit trail.

Lease configuration

Navigate complex arrangements involving lease modifications, subleases, sale-leaseback transactions, lease incentives, and related-party leases.

Accounting and administration, streamlined

Centralize your lease financials into a single sub-ledger across all asset types and lease scenarios, including master leases, embedded leases, and subleases.

Understanding Lease Accounting Software

Why use lease accounting software?

Specialized software offers several advantages for organizations navigating ASC 842 and IFRS 16 compliance:

- Automated compliance: Applies the latest accounting rules, reducing errors and ensuring accurate reporting

- Centralized data management: Consolidates lease information, improving integrity and accessibility

- Efficiency gains: Automates calculations and report generation, saving time and resources

- Enhanced visibility: Provides real-time insights into lease portfolios through dashboards and reporting tools

- Audit readiness: Maintains detailed trails and documentation, simplifying the audit process

- Scalability: Adapts to growing portfolios and evolving accounting standards

By leveraging purpose-built software, organizations can ensure accuracy, save time, and gain valuable insights while maintaining compliance with complex lease accounting requirements

What is lease accounting software?

Lease accounting software is a specialized solution designed to help companies manage their leases, implement internal controls, and streamline accounting while complying with the financial reporting requirements for leases set forth by the International Financial Reporting Standards (IFRS), the Financial Accounting Standards Board (FASB) and the Governmental Accounting Standards Boards (GASB).

The software typically automates the process of recording lease-related transactions, calculating and recognizing lease expenses and income, and producing financial reports and disclosures. It can be used to manage all types of leases, including real estate, equipment, and other assets. Lease accounting software helps companies reduce errors, increase efficiency, and ensure compliance with accounting standards. It also offers greater visibility into lease portfolios, enabling more informed decisions about leasing activities.

For the public sector, lease accounting software also offers accounting and reporting tools for subscription-based IT agreements to support compliance with GASB 96. This new guidance from the GASB is based on the guidance for GASB 87 for leases, ensuring that software agreements are recognized as ROU Assets and corresponding liabilities.

What are the key features of lease accounting software?

Robust lease accounting solutions offer essential features to facilitate ASC 842 compliance and streamline lease management:

- Right-of-use asset calculation: Automates valuation, considering initial measurement, adjustments, and amortization

- Lease liability tracking: Accurately records and updates liabilities on the balance sheet

- Discount rate management: Facilitates input and management of borrowing rates for accurate present value calculations

- Compliant journal entries: Generates entries for lease recognition, measurements, and modifications

- Classification tests: Performs and documents tests to determine lease classification

- Disclosure reporting: Produces comprehensive reports required by ASC 842

- Modification tracking: Captures and accounts for changes in lease terms, payments, or scope

- Multi-currency support: Handles leases in various currencies, performing necessary conversions

These features enable organizations to maintain compliance while improving efficiency and accuracy in lease management processes. For a comprehensive understanding of lease accounting requirements, a complete guide to lease accounting can provide valuable insights.

What controls should be implemented for lease accounting compliance?

Lease controls fall into four main categories: Transition-related Controls, Financial Reporting Controls, Activity-related Controls, and IT General Controls. Internal controls should be established in two phases: during the transition and after its implementation.

Transition-related controls are short-term controls that focus on the transition period when implementing the new lease accounting standards, however, they have ongoing relevance after the transition period, and may need to be revisited if improperly implemented or policies change. These controls are designed to minimize risks related to:

- Identification of all leases and lease obligations

- Accuracy of scripts for reports and journal entries

- Accuracy and completeness of the recording of the adoption of the lease standard

- Accuracy and completeness of accounting conclusions

Financial reporting controls should cover:

- Additions to GAAP/Disclosure checklists related to ASC 842

- Changes to inserts/footnote disclosures for ASC 842 compliance

- Recalculation/review of data intensive elements, including weighted average calculations and variable lease payments

- Reconciliation of lease disclosures to related system reports

Activity related controls should cover:

- Standardization of data and documentation

- Identification of embedded leases

- Classification of operating vs. financing leases

- Timely identification of lease modifications.

- Review/approval of new leases and changes to leases

- Calculation/recording of leasehold assets and liabilities

- Safeguarding of assets

IT General Controls should cover:

- Completeness and accuracy of source data and system interfaces

- Review/approval through workflow management of changes to lease information

- Segregation of duties

- ITGC change management, logical access, and operations controls over the new leasing system

- Implementation of audit trail

Lease controls will look different at every organization depending on the people, processes, and technologies applied to the control environment, and you should work with your accounting advisor to implement policies and procedures to ensure a smooth audit.

To learn more about controls under the new lease accounting standards, read our blog: Mastering Lease Accounting Internal Controls: Unveiling the Key Categories for Compliance

What software features ensure effective lease accounting controls?

Lease controls will look different at every organization, but software can help automate or enable both preventative and detective controls for lease accounting.

Standardization of Data and Documentation can help maintain consistent recordkeeping over time and make it easier to review past records when searching for the source of a discrepancy. The lack of standardization can cause items to be overlooked or misinterpreted in a search for discrepancies

Features to look for:

- Robust lease administration creates a single source of truth across teams and forces organizations to enter contracts and extract clauses in the same format and run calculations in a consistent way

- Import templates that automatically map to the system settings and configurations you decide on in implementation standardize data and streamline data entry

- Pre-built, third-party tested reports and calculations ensure consistency and accuracy.

Separation of duties defines roles across a transaction – who can start a transaction, who can review a transaction, who can approve a transaction, who can report on a transaction, reducing the risk of fraud and errors.

Ideally, no single person should have sole control over each step in the lifespan of a transaction. Separation of duties splits the responsibility for bookkeeping, deposits, reporting and auditing.

- Defined user profiles allow admins to define which contracts each user has access to and what actions they can take. -You’re should be- able to restrict access down to the lease level based on the filters that make sense to your org (region, department, org structure, etc.)

Authorizations and Approvals are combined features to enforce. Authorization is the power granted to an employee to perform a task while approval is the act of ensuring an activity is consistent with an organization’s rules and procedures.

The person who authorizes a transaction should be different from the person who approves it.-Any lease accounting system should allow admins to designate roles and approvers for each stage of a transaction while maintaining a detailed audit trail.

System access controls gate access to different parts of an accounting system via passwords, lockouts and electronic access logs can keep unauthorized users out of the system. It also provides a way to audit the usage of the system to identify the source of errors or discrepancies. Robust access tracking can also serve as a deterrent to fraudulent access in the first place. Look for an SSAE certification from any vendor, as well as features like defined user profiles, single sign-on and 2-factor authentication.

An audit trail is a sequential record detailing the history and events related to a specific transaction or ledger history. It provides a step-by-step record to trace accounting, trade details, or other financial data back to their source. Any lease accounting system should provide an audit trail for each lease, as well as reports like:

- Change Log Report – provides an audit trail of field changes to components of one or more lease records, tracking which user made each change and when, and the old and new values of each field.

- Disclosure report – should include a maturity analysis to understand the detailed transactions that justify the numbers in the disclosure to speed the audit.

For a deeper dive into internal controls for lease accounting compliance, check out our blog: Mastering Lease Accounting Compliance: Top 7 Control Activities and How Technology Can Help

What common risks does lease accounting software solve?

Lease accounting standards add to the complexity of reporting on assets and liabilities. The standards add real estate and equipment lease requirements and change how leases are classified, which in turn affects how leases are calculated on the balance sheet and reflected during your audit. Without a lease accounting solution to help with lease tracking, reporting and management, your business may be exposed to a number of risks including:

- Inconsistencies in the way assets are accounted for

- Human error in calculations or in migrating data from one source to another

- Widely dispersed lease records rather than a central data repository

- Lack of visibility into lease terms, changes and important dates

- Missing details such as embedded leases that are part of larger contracts

- Lack of a structured change management process

- Mistakes in complex calculations for common area maintenance (CAM) and other costs

- No record of what changes have been made to leases, when and by whom

- Increased odds of failing an audit

The best lease accounting software addresses all these risks and more. It puts a secure system in place for capturing all the necessary data, tracking changes and reporting lease costs in accordance with your accounting policies and procedures as well as with ASC, GASB or IFRS requirements.

Get more details in our blog:Lease accounting auditing risks multiply without software.

What are the benefits of lease accounting software?

There are many reasons to adopt a lease accounting software solution, but the three most essential benefits combined can help your business grow, and protect it from risk.

Benefit 1: Improved productivity and efficiency

The best lease accounting software uses smart, intuitive system design to eliminate manual processes, therefore making it easy to accomplish tasks quickly.

Improving employee productivity is a KPI for just about every organization, regardless of size or industry. If your lease accounting tool is cumbersome and complicated to use, it will slow people down and hinder their work.

To test the time-saving value of a lease accounting software solution, consider the following:

- Does the system allow you to enter data once and use it throughout the system (rather than entering the same thing in multiple places)?

- Does the system support mass updates to different groups of assets such as based on entity, country, brand or asset class?

- Does the system support configurable alerts based on asset profile, or based on user groups?

- Does the system accept updates to master data in the administrative settings (such as GL codes) rather than having to pay for a vendor CR each time?

These four areas are just some of the key factors that impact how quickly and easily you can accomplish what you need to within your lease accounting software.

Benefit 2: Make better leasing decisions with lease accounting software

With all leases being brought onto the balance sheet, organizations — and their auditors — are taking a much closer look at leasing decisions. Can the lease accounting tool you’re considering help you make the most cost-effective choices?

For that, you need a central repository of all your lease data.

That’s why the most valuable enterprise lease accounting software aggregates data for real estate, equipment, vehicles, land and anything else your organization leases. It also should collect information used in the day-to-day administration of your leases, not just the payment amounts and dates.

For data to inform your decision making, you’ll also need powerful and flexible reporting and business intelligence tools. Look for the ability to roll up, drill down into the details and produce ad hoc reports that slice and dice your data exactly how you need it.

Benefit 3: Mitigate costly errors and risks

Lease accounting software can help reduce risk in two ways. First, inaccurate financial reports can cause you to fail an audit, which in itself is a huge risk. With lease accounting software’s centralized data and reporting, these risks can be mitigated. Second, lease management software (also called lease controller software) can help reduce the high financial risk that comes with a poorly managed leased portfolio.

How is lease accounting software different for ASC 842 vs IFRS 16?

While ASC 842 and IFRS 16 share the goal of improving lease accounting transparency, they differ in key areas:

- Classification: ASC 842 maintains operating and finance lease distinctions for lessees, while IFRS 16 treats all leases as finance leases

- Income statement impact: Operating leases under ASC 842 result in straight-line expense recognition, whereas IFRS 16 typically leads to front-loaded expenses

- Low-value assets: IFRS 16 provides an optional exemption, which ASC 842 does not offer

- Subleases: Classification differs based on right-of-use asset (IFRS 16) or underlying asset (ASC 842)

- Sale and leaseback transactions: ASC 842 allows partial gain recognition in some cases, while IFRS 16 restricts it to rights transferred to the buyer-lessor

Both standards require lessees to recognize most leases on the balance sheet, representing a significant shift from previous practices. Many organizations utilize specialized software to manage compliance with both standards, facilitating lease management under either framework.

Understanding the nuances between these standards is crucial for multinational companies that may need to report under both. While the overall goals align, differences in application can lead to variations in financial statements and key metrics. For a detailed comparison, exploring the key differences between GAAP and IFRS lease standards can provide valuable insights.

How to implement lease accounting software?

To ensure successful implementation of lease accounting software, organizations should consider the following practices:

- Centralize data: Consolidate all lease information into a single repository

- Establish processes: Define standardized workflows for data entry, review, and approval

- Leverage automation: Utilize the software’s capabilities for classification, accounting, and entry generation

- Customize configuration: Align the software with your organization’s specific policies and reporting needs

- Integrate systems: Connect the software with relevant platforms to enable seamless data flow

- Provide thorough training: Educate users on both software functionality and underlying accounting principles

- Validate data: Conduct comprehensive reviews of migrated lease data to ensure accuracy

- Document decisions: Maintain clear records of policy elections and critical implementation choices

- Plan for diverse leases: Ensure the software can handle various lease types, including embedded leases

- Establish ongoing controls: Implement processes for data maintenance and change management

By adhering to these practices, organizations can maximize their software investment and ensure sustainable compliance with ASC 842 and related standards. It’s important to note that under ASC 842, both operating leases and finance leases are now required to be recorded on the balance sheet, with limited exceptions.